Navigation » List of Schools, Subjects, and Courses » Accounting 102 – Managerial Accounting » Assignments » Assignment 1

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Assignment 1

Assignment 1

1. Match the term and the definition

| Emphasizes decisions affecting the future | |

| Emphasizes relevance. | |

| Emphasizes financial consequences of past activities. | |

| Not required to follow GAAP. | |

| Emphasizes objectivity. |

Planning involves ________.

hiring employees

setting goals and objectives

analyzing financial statements

coordinating company activities

2. Match the term and the definition

| 1. Adventure Holiday sells thousands of tour packages each month through its various branches. A branch manager’s salary would be a(n) _________ of selling a tour package. | |

| 2. A ___________ is a cost that is incurred to support a number of cost objects but cannot be traced to them individually. | |

| 3. Adventure Holiday sells thousands of tour packages each month through its various branches. A branch manager’s salary would be a(n) _________ of the branch. | |

3. Northwest Hospital is a full-service hospital that provides everything from major surgery and emergency room care to outpatient clinics.

Required:

For each of the following costs incurred at Northwest Hospital, indicate whether it would most likely be a direct cost or an indirect cost of the specified cost object.

| Cost | Cost Object | Direct Cost/Indirect Cost |

| 1. The wages of pediatric nurses | The pediatric department | |

| 2. Prescription drugs | A particular patient | |

| 3. Heating the hospital | The pediatric department | |

| 4. The salary of the head of pediatrics | The pediatric department | |

| 5. The salary of the head of pediatrics | a particular pediatric patient | |

| 6. Hospital chaplains salary | A particular patient | |

| 7. Lab tests by outside contractor | A particular patient | |

| 8. Lab tests by outside contractor | A particular department |

4. Materials that become an integral part of the finished product and whose costs can be conveniently traced to the finished product are called ________.

raw materials

direct materials

indirect materials

5. ________ is sometimes called “touch labor.”

Direct labor

Indirect labor

Overhead labor

6. Items such as indirect materials, indirect labor, maintenance and repairs on production equipment, depreciation, and insurance on manufacturing facilities are included in ________.

nonmanufacturing costs

manufacturing overhead costs

direct costs

7. Manufacturing costs include all of the following categories except ________.

administrative costs

direct labor

direct materials

manufacturing overhead

8. Wollogong Group Limited of New South Wales, Australia, acquired its factory building 10 years ago. For several years, the company has rented out a small annex attached to the rear of the building for $30,000 per year. The renter’s lease will expire soon, and rather than renewing the lease, the company has decided to use the annex to manufacture a new product.

Direct materials cost for the new product will total $80 per unit. To have a place to store its finished goods, the company will rent a small warehouse for $500 per month. In addition, the company must rent equipment for $4,000 per month to produce the new product. Direct laborers will be hired and paid $60 per unit to manufacture the new product. As in prior years, the space in the annex will continue to be depreciated at $8,000 per year.

The annual advertising cost for the new product will be $50,000. A supervisor will be hired and paid $3,500 per month to oversee production. Electricity for operating machines will be $1.20 per unit. The cost of shipping the new product to customers will be $9 per unit.

To provide funds to purchase materials, meet payrolls, and so forth, the company will have to liquidate some temporary investments. These investments are presently yielding a return of $3,000 per year.

Required:

Using the table shown below, describe each of the costs associated with the new product decision in four ways. In terms of cost classifications for predicting cost behavior (column 2), indicate whether the cost is fixed or variable. With respect to cost classifications for manufacturers (column 3), if the item is a manufacturing cost, indicate whether it is direct materials, direct labor, or manufacturing overhead. If it is a nonmanufacturing cost, then select “none” as your answer. With respect to cost classifications for preparing financial statements (column 4), indicate whether the item is a product cost or period cost. Finally, in terms of cost classifications for decision making (column 5), identify any items that are sunk costs or opportunity costs. If you identify an item as an opportunity cost, then select “none” as your answer in columns 2-4.

| Name of the Cost | Cost classifications for predicting cost behavior | Cost classifications for manufacturers | Cost classifications for preparing financial statements | Cost classifications for decision making |

| Rental revenue forgone, $30,000 per year | ||||

| Direct materials cost, $80 per unit | ||||

| Rental cost of warehouse, $500 per month | ||||

| Rental cost of equipment, $4,000 per month | ||||

| Direct labor cost, $60 per unit | ||||

| Depreciation ofthe annex space, $,8000 per year | ||||

| Advertising cost, $50,000 per year | ||||

| Supervisor’s salary, $3,500 per month | ||||

| Electricity for machines, $1.20 per unit | ||||

| Shipping cost $9 per unit | ||||

| Return earned on investments, $3,000 per year |

9. How should the wages of a sheet metal worker in a fabrication plant be classified?

Product cost

Period cost

Nonmanufacturing cost

Administrative cost

The ________ requires that the costs incurred to generate a particular revenue should be recognized as expenses in the same period that the revenue is recognized.

materiality concept

consistency concept

matching principle

going concern assumption

10. Cyber Devices manufactures PCTV products that enable people to watch television content on their computers. It sells its product to retailers for $50. A tuner component that goes into each of these devices costs $5 to acquire. The total variable cost at an activity level of 1,000 units equals ________.

$50,000

$5

$1,000

$5,000

11. A fixed cost is a cost which ________.

varies in total with changes in the level of activity

remains constant per unit with changes in the level of activity

varies inversely in total with changes in the level of activity

remains constant in total with changes in the level of activity

12. Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $2,100 and the variable cost per cup of coffee served is $0.45.

Required:

1. Fill in the following table with your estimates of the company’s total cost and average cost per cup of coffee at the indicated levels of activity.

2. Does the average cost per cup of coffee served increase, decrease, or remain the same as the number of cups of coffee served in a week increases?

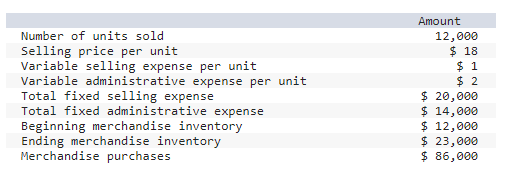

13. Cherokee Incorporated is a merchandiser that provided the following information:

Required:

1. Prepare a traditional income statement.

2. Prepare a contribution format income statement.

14. Harris Company manufactures and sells a single product. A partially completed schedule of the company’s total costs and costs per unit over the relevant range of 52,000 to 92,000 units is given below:

Required:

1. Complete the schedule of the company’s total costs and costs per unit as given in the relevant tab below.

2. Assume that the company produces and sells 82,000 units during the year at a selling price of $10.81 per unit. Prepare a contribution format income statement for the year.

15. The traditional income statement uses which of the following cost categories?

Variable expenses and fixed expenses.

Cost of goods sold and fixed expenses.

Operating expenses and selling and administrative expenses.

Cost of goods sold and selling and administrative expenses.

Audio Corporation purchased $20,000 of DVDs during the current year. The company had DVD inventory of $15,000 at the beginning of the year. An end of the year audit revealed that the company had DVD inventory of $10,000. The amount that would be reported as cost of goods sold in the income statement for the current year is ________.

$25,000

$15,000

$10,000

$20,000

16. Which of the following is true of the contribution approach?

It is mainly used for external reporting purposes.

It separates costs into fixed and variable categories.

It is not useful for merchandising companies.

It calculates gross margin by deducting cost of goods sold from sales.

Knowledge Check 02

Davidson Company has sales of $100,000, variable cost of goods sold of $40,000, variable selling expenses of $15,000, variable administrative expenses of $5,000, fixed selling expenses of $7,000, and fixed administrative expenses of $9,000. What is Davidson’s contribution margin?

multiple choice

84,000

$45,000

$40,000

$8,000