Navigation » List of Schools, Subjects, and Courses » Accounting 102 – Managerial Accounting » Chapter 11 Homework Problems » Chapter 11 Homework Problem 1

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Chapter 11 Homework Problem 1

Chapter 11 Homework Problem 1

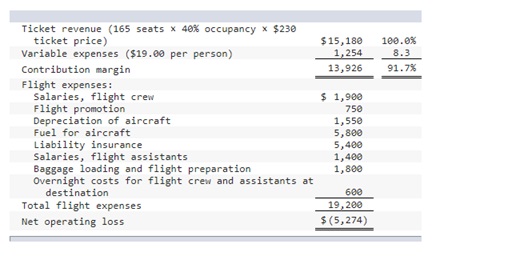

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company’s performance, the company is thinking about dropping several flights that appear to be unprofitable.

A typical income statement for one round-trip of one such flight (flight 482) is as follows:

The following additional information is available about flight 482:

- Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete.

- One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a “high-risk” area. The remaining two-thirds would be unaffected by a decision to drop flight 482.

- The baggage loading and flight preparation expense is an allocation of ground crews’ salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company’s total baggage loading and flight preparation expenses.

- If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight.

- Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible.

- Dropping flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number of flight crew on its payroll.

Required:

- What is the financial advantage (disadvantage) of discontinuing flight 482?