Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homework Chapter 2

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homework Chapter 2

Homework Chapter 2

1. Exercise 2-2A Analyze the impact of transactions on the accounting equation (LO2-2)

Below are the external transactions for Shockers Incorporated.

a. Issue common stock in exchange for cash.

b. Purchase equipment by signing a note payable.

c. Provide services to customers on account.

d. Pay rent for the current month.

e. Pay insurance for the current month.

f. Collect cash from customers on account.

Required:

Analyze each transaction. Under each category in the accounting equation, indicate whether the transaction increases, decreases, or has no effect. The first item is provided as an example.

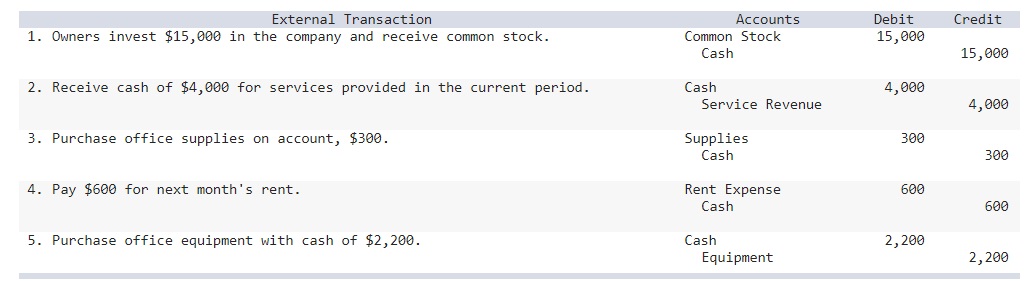

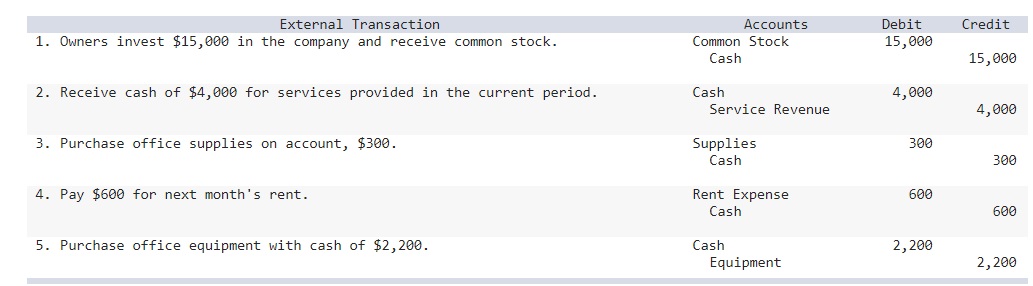

2. Terrapin Company engages in the following external transactions for November.

a. Purchase equipment in exchange for cash of $23,400.

b. Provide services to customers and receive cash of $6,800.

c. Pay the current month’s rent of $1,300.

d. Purchase office supplies on account for $1,000.

e. Pay employee salaries of $2,100 for the current month.

Required:

Record the transactions. Terrapin uses the following accounts: Cash, Supplies, Equipment, Accounts Payable, Service Revenue, Rent Expense, and Salaries Expense. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

3. Sun Devil Hair Design has the following transactions during the month of February.

February 2 Pay $700 for radio advertising for February.

February 7 Purchase beauty supplies of $1,300 on account.

February 14 Provide beauty services of $2,900 to customers and receive cash.

February 15 Pay employee salaries for the current month of $900.

February 25 Provide beauty services of $1,000 to customers on account.

February 28 Pay utility bill for the current month of $300.

Required:

Record each transaction. Sun Devil uses the following accounts: Cash, Accounts Receivable, Supplies, Accounts Payable, Service Revenue, Advertising Expense, Salaries Expense, and Utilities Expense. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

4. Bearcat Construction begins operations in March and has the following transactions.

March 1 Issue common stock for $21,000.

March 5 Obtain $9,000 loan from the bank by signing a note.

March 10 Purchase construction equipment for $25,000 cash.

March 15 Purchase advertising for the current month for $1,100 cash.

March 22 Provide construction services for $18,000 on account.

March 27 Receive $13,000 cash on account from March 22 services.

March 28 Pay salaries for the current month of $6,000.

Required:

Record each transaction. Bearcat uses the following accounts: Cash, Accounts Receivable, Equipment, Notes Payable, Common Stock, Service Revenue, Advertising Expense, and Salaries Expense. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

5. Required information

Exercise 2-12A Correct recorded transactions (LO2-4)

Skip to question

[The following information applies to the questions displayed below.]

Below are several transactions for Scarlet Knight Corporation. A junior accountant, recently employed by the company, proposes to record the following transactions.

Required:

1. Assess whether the proposed entries are correct or incorrect.

6.

Exercise 2-12A Correct recorded transactions (LO2-4)

Skip to question

[The following information applies to the questions displayed below.]

Below are several transactions for Scarlet Knight Corporation. A junior accountant, recently employed by the company, proposes to record the following transactions.

2. Provide a correct entry for each of the transactions classified as incorrect. (If no entry is required to correct a transaction/event, select “No Journal Entry Required” in the first account field.)

7.

Consider the following transactions.

a. Receive cash from customers, $15,000.

b. Pay cash for employee salaries, $9,000.

c. Pay cash for rent, $3,000.

d. Receive cash from sale of equipment, $8,000.

e. Pay cash for utilities, $1,000.

f. Receive cash from a bank loan, $4,000.

g. Pay cash for advertising, $7,000.

h. Purchase supplies on account, $3,000.

Required:

Post transactions to the Cash T-account and calculate the ending balance

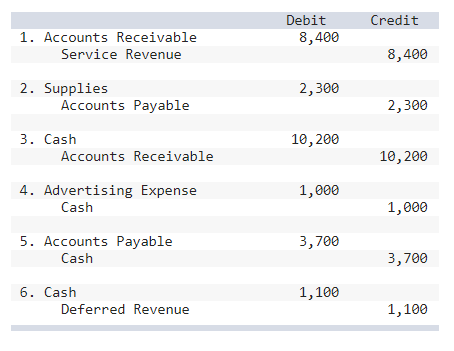

8. Consider the recorded transactions below.

Required:

Post each transaction to T-accounts and compute the ending balance of each account. The beginning balance of each account before the transactions is: Cash, $3,400; Accounts Receivable, $4,200; Supplies, $400; Accounts Payable, $3,500; Deferred Revenue, $300. Service Revenue and Advertising Expense each have a beginning balance of zero.

9.

Below is the complete list of accounts of Sooner Company and the related balance at the end of April. All accounts have their normal debit or credit balance. Cash, $3,900; Prepaid Rent, $7,400; Accounts Payable $4,300; Common Stock, $40,000; Service Revenue, $25,400; Salaries Expense, $8,200; Accounts Receivable, $6,100; Land, $60,000; Deferred Revenue, $2,300; Retained Earnings, $23,000; Supplies Expense, $9,400.

Required:

Prepare a trial balance.

10. [The following information applies to the questions displayed below.]

Green Wave Company plans to own and operate a storage rental facility. For the first month of operations, the company has the following transactions.

1. January 1 Issue 10,000 shares of common stock in exchange for $42,000 in cash.

2. January 5 Purchase land for $24,000. A note payable is signed for the full amount.

3. January 9 Purchase storage container equipment for $9,000 cash.

4. January 12 Hire three employees for $3,000 per month.

5. January 18 Receive cash of $13,000 in rental fees for the current month.

6. January 23 Purchase office supplies for $3,000 on account.

7. January 31 Pay employees $9,000 for the first month’s salaries.

1. Record each transaction. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

11

2. Post each transaction to T-accounts and calculate the ending balance for each account. For each posting, indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero.

12

Prepare a trial balance.

13

[The following information applies to the questions displayed below.]

Boilermaker House Painting Company incurs the following transactions for September.

1. September 3 Paint houses in the current month for $20,000 on account.

2. September 8 Purchase painting equipment for $21,000 cash.

3. September 12 Purchase office supplies on account for $3,500.

4. September 15 Pay employee salaries of $4,200 for the current month.

5. September 19 Purchase advertising to appear in the current month for $1,000 cash.

6. September 22 Pay office rent of $5,400 for the current month.

7. September 26 Receive $15,000 from customers in (1) above.

8. September 30 Receive cash of $6,000 in advance from a customer who plans to have his house painted in the following month.

Required information

Required:

1. Record each transaction. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

14

2. Post each transaction to T-accounts and calculate the ending balance for each account. At the beginning of September, the company had the following account balances: Cash, $46,100; Accounts Receivable, $1,700; Supplies, $500; Equipment, $7,400; Accounts Payable, $1,200; Common Stock, $25,000; Retained Earnings, $29,500. All other accounts had a beginning balance of zero.

15.

3. Prepare a trial balance.