Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homework Chapter 3

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homework Chapter 3

Homework Chapter 3

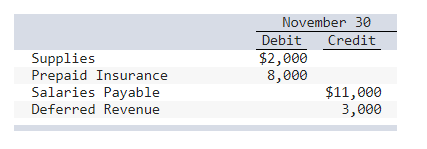

1. Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information:

The following information is known for the month of December:

1. Purchases of supplies during December total $4,500. Supplies on hand at the end of December equal $3,500.

2. No insurance payments are made in December. Insurance cost is $2,000 per month.

3. November salaries payable of $11,000 were paid to employees in December. Additional salaries for December owed at the end of the year are $16,000.

4. On November 1, a tenant paid Golden Eagle $4,500 in advance rent for the period November through January, and Deferred Revenue was credited for the entire amount.

Required:

Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and deferred revenue on December 31. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2. Consider the following transactions for Huskies Insurance Company:

Equipment costing $42,000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year.

On June 30, the company lends its chief financial officer $50,000; principal and interest at 7% are due in one year.

On October 1, the company receives $16,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited.

Required:

For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

3. Consider the following situations for Shocker:

1. On November 28, 2021, Shocker receives a $4,500 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

2. On December 1, 2021, the company pays a local radio station $2,700 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited.

3. Employee salaries for the month of December totaling $8,000 will be paid on January 7, 2022.

4. On August 31, 2021, Shocker borrows $70,000 from a local bank. A note is signed with principal and 9% interest to be paid on August 31, 2022.

Required:

Record the necessary adjusting entries for Shocker at December 31, 2021. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

4.

Below are transactions for Wolverine Company during 2021.

1. On December 1, 2021, Wolverine receives $4,000 cash from a company that is renting office space from Wolverine. The payment, representing rent for December and January, is credited to Deferred Revenue.

2. Wolverine purchases a one-year property insurance policy on July 1, 2021, for $13,200. The payment is debited to Prepaid Insurance for the entire amount.

3. Employee salaries of $3,000 for the month of December will be paid in early January 2022.

4. On November 1, 2021, the company borrows $15,000 from a bank. The loan requires principal and interest at 10% to be paid on October 30, 2022.

5. Office supplies at the beginning of 2021 total $1,000. On August 15, Wolverine purchases an additional $3,400 of office supplies, debiting the Supplies account. By the end of the year, $500 of office supplies remains.

Required:

Record the necessary adjusting entries at December 31, 2021, for Wolverine Company. You do not need to record transactions made during the year. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

5. Below are transactions for Hurricane Company during 2021.

-

On October 1, 2021, Hurricane lends $9,000 to another company. The other company signs a note indicating principal and 12% interest will be paid to Hurricane on September 30, 2022.

-

On November 1, 2021, Hurricane pays its landlord $4,500 representing rent for the months of November through January. The payment is debited to Prepaid Rent for the entire amount.

-

On August 1, 2021, Hurricane collects $13,200 in advance from another company that is renting a portion of Hurricane’s factory. The $13,200 represents one year’s rent and the entire amount is credited to Deferred Revenue.

-

Depreciation on machinery is $5,500 for the year.

-

Salaries for the year earned by employees but not paid to them or recorded are $5,000.

-

Hurricane begins the year with $1,500 in supplies. During the year, the company purchases $5,500 in supplies and debits that amount to Supplies. At year-end, supplies costing $3,500 remain on hand.

Required:

Record the necessary adjusting entries at December 31, 2021, for Hurricane Company for each of the situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

6.

[The following information applies to the questions displayed below.]

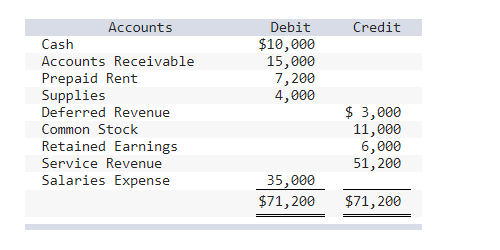

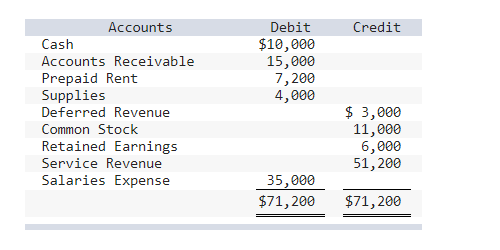

The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below.

At year-end, the following additional information is available:

-

The balance of Prepaid Rent, $7,200, represents payment on October 31, 2021, for rent from November 1, 2021, to April 30, 2022.

-

The balance of Deferred Revenue, $3,000, represents payment in advance from a customer. By the end of the year, $750 of the services have been provided.

-

An additional $700 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2022.

-

The balance of Supplies, $4,000, represents the amount of office supplies on hand at the beginning of the year of $1,700 plus an additional $2,300 purchased throughout 2021. By the end of 2021, only $800 of supplies remains.

Required:

Update account balances for the year-end information by recording any necessary adjusting entries. No prior adjustments have been made in 2021. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

7. [The following information applies to the questions displayed below.]

The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below.

At year-end, the following additional information is available:

-

The balance of Prepaid Rent, $7,200, represents payment on October 31, 2021, for rent from November 1, 2021, to April 30, 2022.

-

The balance of Deferred Revenue, $3,000, represents payment in advance from a customer. By the end of the year, $750 of the services have been provided.

-

An additional $700 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2022.

-

The balance of Supplies, $4,000, represents the amount of office supplies on hand at the beginning of the year of $1,700 plus an additional $2,300 purchased throughout 2021. By the end of 2021, only $800 of supplies remains.

2. Prepare an adjusted trial balance as of December 31, 2021.

8. Below are the restated amounts of net income and retained earnings for Volunteers Inc. and Raiders Inc. for the period 2012–2021. Volunteers began operations in 2013, while Raiders began several years earlier.

Required:

Calculate the balance of retained earnings each year for each company. Neither company paid dividends during this time. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Amounts to be deducted should be indicated by a minus sign.)

9

[The following information applies to the questions displayed below.]

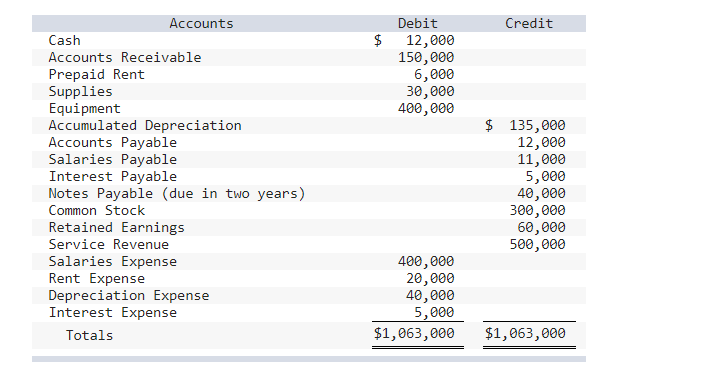

The December 31, 2021, adjusted trial balance for Fightin’ Blue Hens Corporation is presented below.

Required:

1. Prepare an income statement for the year ended December 31, 2021.

10.

2. Prepare a statement of stockholders’ equity for the year ended December 31, 2021, assuming no common stock was issued during 2021.

11.

3. Prepare a classified balance sheet as of December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.)

12.

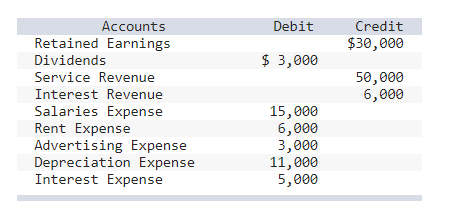

Seminoles Corporation’s fiscal year-end is December 31, 2021. The following is a partial adjusted trial balance as of December 31.

Required:

1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2. Calculate the ending balance of Retained Earnings.

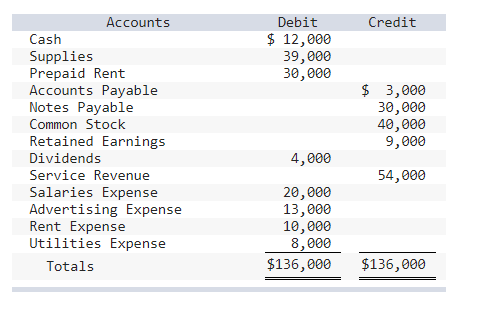

13. Laker Incorporated’s fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31.

Required:

1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2. Calculate the ending balance of Retained Earnings.

3. Prepare a post-closing trial balance.

14. The following information applies to the questions displayed below.]

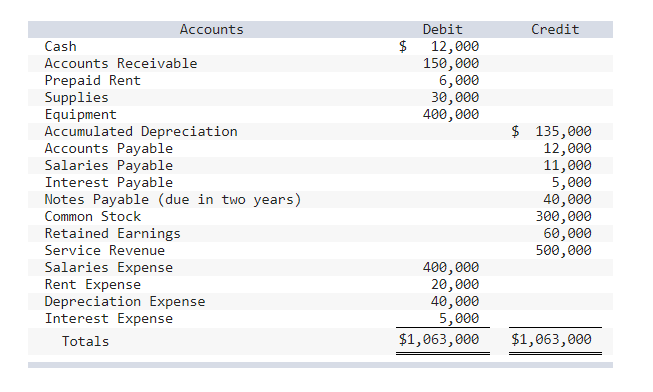

The December 31, 2021, adjusted trial balance for Fightin’ Blue Hens Corporation is presented below.

Exercise 3-19A Part 1

Required:

1. Record the necessary closing entries at December 31, 2021. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

15.

2. Prepare a post-closing trial balance.

16.

[The following information applies to the questions displayed below.]

On January 1, 2021, Red Flash Photography had the following balances: Cash, $12,000; Supplies, $8,000; Land, $60,000; Deferred Revenue, $5,000; Common Stock $50,000; and Retained Earnings, $25,000. During 2021, the company had the following transactions:

| 1. | February | 15 | Issue additional shares of common stock, $20,000. | |||

| 2. | May | 20 | Provide services to customers for cash, $35,000, and on account, $30,000. | |||

| 3. | August | 31 | Pay salaries to employees for work in 2021, $23,000. | |||

| 4. | October | 1 | Purchase rental space for one year, $12,000. | |||

| 5. | November | 17 | Purchase supplies on account, $22,000. | |||

| 6. | December | 30 | Pay dividends, $2,000. |

The following information is available on December 31, 2021:

- Employees are owed an additional $4,000 in salaries.

- Three months of the rental space has expired.

- Supplies of $5,000 remain on hand.

- All of the services associated with the beginning deferred revenue have been performed.

Exercise 3-20A Part 1

Required:

1. Record the transactions that occurred during the year. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

17.

2. Record the adjusting entries at the end of the year. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field. Do not round intermediate calculations.)

18.

3. Prepare an adjusted trial balance.

19.

4. Prepare an income statement, statement of stockholders’ equity, and classified balance sheet.

20.

5. Prepare closing entries. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

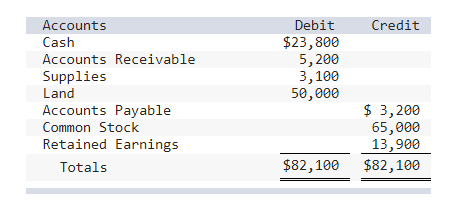

21. [The following information applies to the questions displayed below.]

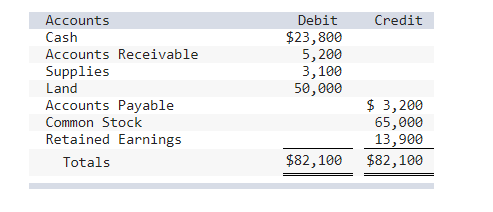

On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances:

During January 2021, the following transactions occur:

January 2 Purchase rental space for one year in advance, $6,000 ($500/month).

January 9 Purchase additional supplies on account, $3,500.

January 13 Provide services to customers on account, $25,500.

January 17 Receive cash in advance from customers for services to be provided in the future, $3,700.

January 20 Pay cash for salaries, $11,500.

January 22 Receive cash on accounts receivable, $24,100.

January 29 Pay cash on accounts payable, $4,000.

1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

22.

Exercise 3-21A Part 2

Rent for the month of January has expired.

Supplies remaining at the end of January total $2,800.

By the end of January, $3,200 of services has been provided to customers who paid in advance on January 17.

Unpaid salaries at the end of January are $5,800.

2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

23.

3. Prepare an adjusted trial balance as of January 31, 2021.

24. On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances:

During January 2021, the following transactions occur:

January 2 Purchase rental space for one year in advance, $6,000 ($500/month).

January 9 Purchase additional supplies on account, $3,500.

January 13 Provide services to customers on account, $25,500.

January 17 Receive cash in advance from customers for services to be provided in the future, $3,700.

January 20 Pay cash for salaries, $11,500.

January 22 Receive cash on accounts receivable, $24,100.

January 29 Pay cash on accounts payable, $4,000.

4. Prepare an income statement for the period ended January 31, 2021.

25.

5. Prepare a classified balance sheet as of January 31, 2021.

26.

6. Record closing entries. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

27.

7. Analyze the following features of Dynamite Fireworks’ financial condition:

a. What is the amount of profit reported for the month of January?

b. Calculate the ratio of current assets to current liabilities at the end of January.

c. Based on Dynamite Fireworks’ profit and ratio of current assets to current liabilities, indicate whether Dynamite Fireworks appears to be in good or bad financial condition.