Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homework Chapter 4

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homework Chapter 4

Homework Chapter 4

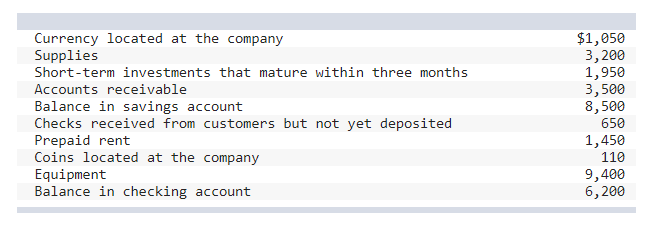

1. Below are several amounts reported at the end of the year.

Required:

Calculate the amount of cash to report in the balance sheet.

2. Spielberg Company’s general ledger shows a checking account balance of $22,970 on July 31, 2021. The July cash receipts of $1,885, included in the general ledger balance, are placed in the night depository at the bank on July 31 and processed by the bank on August 1. The bank statement dated July 31 shows bank service fees of $55. The bank processes all checks written by the company by July 31 and lists them on the bank statement, except for one check totaling $1,460. The bank statement shows a balance of $22,490 on July 31.

Required:

1. Prepare a bank reconciliation to calculate the correct ending balance of cash on July 31, 2021. (Amounts to be deducted should be indicated with a minus sign.)

2. Record the necessary entry(ies) to adjust the balance for cash. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

3. On August 31, 2021, the general ledger of The Dean Acting Academy shows a balance for cash of $7,944. Cash receipts yet to be deposited into the checking account total $3,338, and checks written by the academy but not yet processed by the bank total $1,425. The company’s balance of cash does not reflect a bank service fee of $35 and interest earned on the checking account of $46. These amounts are included in the balance of cash of $6,042 reported by the bank as of the end of August.

Required:

1. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2021. (Amounts to be deducted should be indicated with a minus sign.)

2. Record the necessary entry(ies) to adjust the balance for cash. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

4.

On October 31, 2021, Damon Company’s general ledger shows a checking account balance of $8,397. The company’s cash receipts for the month total $74,320, of which $71,295 has been deposited in the bank. In addition, the company has written checks for $72,467, of which $70,982 has been processed by the bank.

The bank statement reveals an ending balance of $11,727 and includes the following items not yet recorded by Damon: bank service fees of $150, note receivable collected by the bank of $5,000, and interest earned on the account balance plus from the note of $320. After closer inspection, Damon realizes that the bank incorrectly charged the company’s account $300 for an automatic withdrawal that should have been charged to another customer’s account. The bank agrees to the error.

Required:

1. Prepare a bank reconciliation to calculate the correct ending balance of cash on October 31, 2021. (Amounts to be deducted should be indicated with a minus sign.)

2. Record the necessary entries to adjust the balance for cash. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

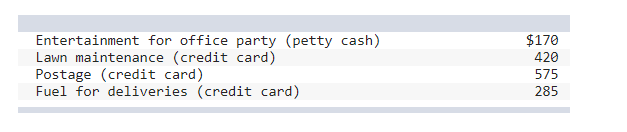

5. Halle’s Berry Farm establishes a $200 petty cash fund on September 4 to pay for minor cash expenditures. The fund is replenished at the end of each month. At the end of September, the fund contains $30 in cash. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items:

Required:

Record the establishment of the petty cash fund on September 4.

Record credit card expenditures during the month. The credit card balance is not yet paid.

Record petty cash expenditures during the month.

(If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

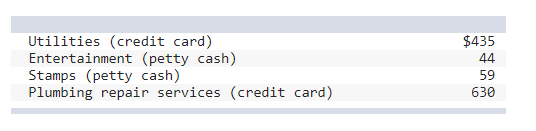

6. T. L. Jones Trucking Services establishes a petty cash fund on April 3 for $200. By the end of April, the fund has a cash balance of $97. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items:

Required:

Record the establishment of the petty cash fund on April 3.

Record credit card expenditures during the month. The credit card balance is paid in full on April 30.

Record petty cash expenditures during the month.

(If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

7. Below are several transactions for Meyers Corporation for 2021.

Issue common stock for cash, $60,000.

Purchase building and land with cash, $45,000.

Provide services to customers on account, $8,000.

Pay utilities on building, $1,500.

Collect $6,000 on account from customers.

Pay employee salaries, $10,000.

Pay dividends to stockholders, $5,000.

Required:

a For each transaction, determine the amount of cash flows. If cash is involved in the transaction, select whether Meyers should classify it as operating, investing, or financing in a statement of cash flows. (Enter N/A if the question is not applicable to the statement. List cash outflows as negative amounts.)

b.calculate net cash flows for the year. (List cash outflows as negative amounts.)

c. Assuming the balance of cash on January 1, 2021, equals $5,400, calculate the balance of cash on December 31, 2021.

8. Below are cash transactions for Goldman Incorporated, which provides consulting services related to mining of precious metals.

Cash used for purchase of office supplies, $2,400.

Cash provided from consulting to customers, $50,600.

Cash used for purchase of mining equipment, $83,000.

Cash provided from long-term borrowing, $70,000.

Cash used for payment of employee salaries, $25,000.

Cash used for payment of office rent, $13,000.

Cash provided from sale of equipment purchased in c. above, $23,500.

Cash used to repay a portion of the long-term borrowing in d. above, $45,000.

Cash used to pay office utilities, $5,300.

Purchase of company vehicle, paying $11,000 cash.

Required:

Calculate cash flows from operating activities. (List cash outflows as negative amounts.)

9.

Below are cash transactions for Goldman Incorporated, which provides consulting services related to mining of precious metals.

- Cash used for purchase of office supplies, $2,400.

- Cash provided from consulting to customers, $50,600.

- Cash used for purchase of mining equipment, $83,000.

- Cash provided from long-term borrowing, $70,000.

- Cash used for payment of employee salaries, $25,000.

- Cash used for payment of office rent, $13,000.

- Cash provided from sale of equipment purchased in c. above, $23,500.

- Cash used to repay a portion of the long-term borrowing in d. above, $45,000.

- Cash used to pay office utilities, $5,300.

- Purchase of company vehicle, paying $11,000 cash.

Required:

Calculate cash flows from investing activities. (List cash outflows as negative amounts.)

10. Below are cash transactions for Goldman Incorporated, which provides consulting services related to mining of precious metals.

Cash used for purchase of office supplies, $2,400.

Cash provided from consulting to customers, $50,600.

Cash used for purchase of mining equipment, $83,000.

Cash provided from long-term borrowing, $70,000.

Cash used for payment of employee salaries, $25,000.

Cash used for payment of office rent, $13,000.

Cash provided from sale of equipment purchased in c. above, $23,500.

Cash used to repay a portion of the long-term borrowing in d. above, $45,000.

Cash used to pay office utilities, $5,300.

Purchase of company vehicle, paying $11,000 cash.

Required:

Calculate cash flows from financing activities. (List cash outflows as negative amounts.)

11. Consider the following information:

Service Revenue for the year = $80,000. Of this amount, $70,000 is collected during the year and $10,000 is expected to be collected next year.

Salaries Expense for the year = $40,000. Of this amount, $35,000 is paid during the year and $5,000 is expected to be paid next year.

Advertising Expense for the year = $10,000. All of this amount is paid during the year.

Supplies Expense for the year = $4,000. No supplies were purchased during the year.

Utilities Expense for the year = $12,000. Of this amount, $11,000 is paid during the year and $1,000 is expected to be paid next year.

Cash collected in advance from customers for services to be provided next year (Deferred Revenue) = $2,000.

Required:

Calculate operating cash flows. (List cash outflows as negative amounts.)

Calculate net income. (List expenses as negative amounts.)