Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 3

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Quiz 3

Quiz 3

1. During the year, Cheng Company paid salaries of $23,100. In addition, $8,900 in salaries has accrued by the end of the year but has not been paid. The year-end adjusting entry would include which one of the following?

2. At the beginning of December, Global Corporation had $2,700 in supplies on hand. During the month, supplies purchased amounted to $3,200, but by the end of the month the supplies balance was only $1,500. What is the appropriate month-end adjusting entry?

3. Eve’s Apples opened for business on January 1, 2021, and paid for two insurance policies effective that date. The liability policy was $55,800 for 18 months, and the crop damage policy was $26,400 for a two-year term. What was the balance in Eve’s Prepaid Insurance account as of December 31, 2021?

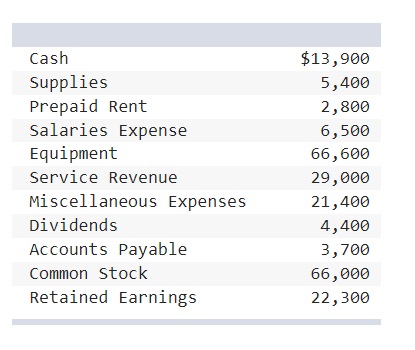

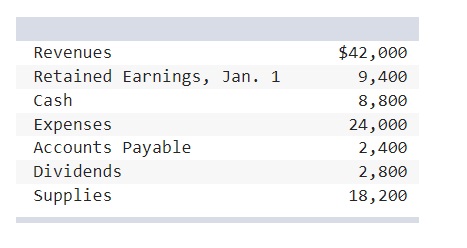

4. The following table contains financial information for Trumpeter Inc. before closing entries:

What is Trumpeter’s net income?

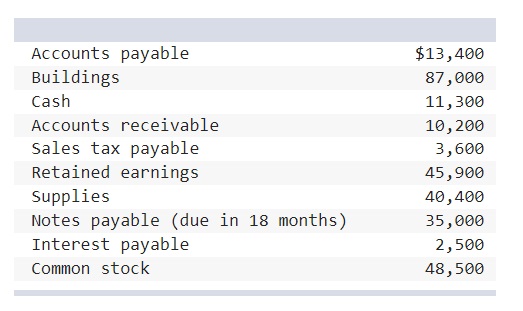

5. The following financial information is from Shovels Construction Company:

What is the amount of current assets, assuming the accounts above reflect normal activity?

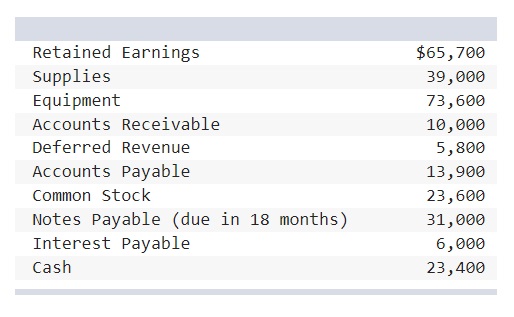

6. The following financial information is from Bronco Company. All debt is due within one year unless stated otherwise.

What is the amount of current liabilities?

7. The following table contains financial information for Trumpter Inc. before closing entries:

What is the amount of Trumpter’s total assets?

8. The ending retained earnings balance of Juan’s Mexican Restaurant chain increased by $4.6 million from the beginning of the year. The company declared a dividend of $1.6 million during the year. What was the amount of net income during the year?

9. The retained earnings account had a beginning credit balance of $26,150. During the period, the business had a net loss $12,500, and the company paid dividends of $8,700. The ending balance in the retained earnings account is:

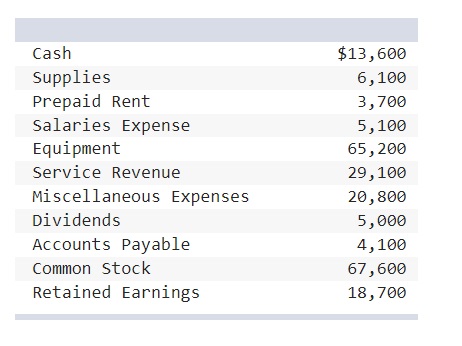

10. Frosty Inc. has the following balances on December 31 prior to closing entries:

Based upon the balances above, what net adjustment would be made to Retained Earnings due to closing entries?