Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homework Chapter 5

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homework Chapter 5

Homework Chapter 5

1. On May 7, Juanita Construction provides services on account to Michael Wolfe for $4,000. Michael pays for those services on May 13.

Required:

For Juanita Construction, record the service on account on May 7 and the collection of cash on May 13. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2. Merry Maidens Cleaning generally charges $300 for a detailed cleaning of a normal-size home. However, to generate additional business, Merry Maidens is offering a new-customer discount of 10%. On May 1, Ms. E. Pearson has Merry Maidens clean her house and pays cash equal to the discounted price.

Required:

Record the revenue recognized by Merry Maidens Cleaning on May 1. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

3. On March 12, Medical Waste Services provides services on account to Grace Hospital for $11,000, terms 2/10, n/30. Grace pays for those services on March 20.

Required:

For Medical Waste Services, record the service on account on March 12 and the collection of cash on March 20. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

4. On March 12, Medical Waste Services provides services on account to Grace Hospital for $11,000, terms 2/10, n/30. Grace does not pay for services until March 31, missing the 2% sales discount.

Required:

For Grace Hospital, record the purchase of services on account on March 12 and the payment of cash on March 31. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

5. On April 25, Foreman Electric installs wiring in a new home for $3,500 on account. However, on April 27, Foreman’s electrical work does not pass inspection, and Foreman grants the customer an allowance of $600 because of the problem. The customer makes full payment of the balance owed on April 30.

rev: 03_12_2021_QC_CS-257133

Required:

1. 2. & 3. Record the journal entries for the above information. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

6.

4. Calculate net revenue associated with these transactions.

7. During 2021, its first year of operations, Pave Construction provides services on account of $160,000. By the end of 2021, cash collections on these accounts total $110,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $10,000.

Required:

1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2-a. Record the write-off of accounts receivable in 2022. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

2-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).

3-a. Assume the same facts as above but assume actual write-offs in 2022 were $15,000. Record the write-off of accounts receivable in 2022. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

3-b. Assume the same facts as above but assume actual write-offs in 2022 were $15,000. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).

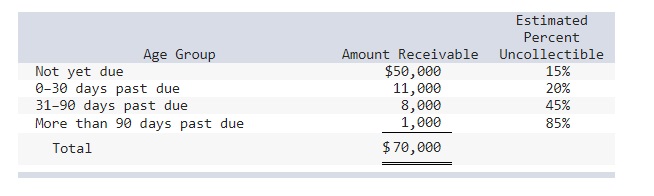

8 Mercy Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below.

Required:

1. Estimate the amount of uncollectible receivables.

2. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

3. Calculate net accounts receivable.

9. At the beginning of 2021, Brad’s Heating & Air (BHA) has a balance of $26,000 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022.

During 2021, install air conditioning systems on account, $190,000.

During 2021, collect $185,000 from customers on account.

At the end of 2021, estimate that uncollectible accounts total 15% of ending accounts receivable.

In 2022, customers’ accounts totaling $8,000 are written off as uncollectible.

Exercise 5-13A Part 1

Required:

1. Record each transaction using the allowance method. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

10.

At the beginning of 2021, Brad’s Heating & Air (BHA) has a balance of $26,000 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022.

During 2021, install air conditioning systems on account, $190,000.

During 2021, collect $185,000 from customers on account.

At the end of 2021, estimate that uncollectible accounts total 15% of ending accounts receivable.

In 2022, customers’ accounts totaling $8,000 are written off as uncollectible.

Exercise 5-13A Part 2

2. Record each transaction using the direct write-off method. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

11.

Exercise 5-13A Part 3

3. Calculate bad debt expense for 2021 and 2022 under the allowance method and under the direct write-off method, prior to any adjusting entries in 2022. (Leave no cells blank.)

12. On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $11,000. In payment for the services, Whole Grain Bakery signs a 9% note requiring the payment of the face amount and interest to Terrell & Associates on September 1.

Required:

For Terrell & Associates, record the acceptance of the note receivable on March 1 and the cash collection on September 1. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

13.

On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $11,000. In payment for the services, Whole Grain Bakery signs a 9% note requiring the payment of the face amount and interest to Terrell & Associates on September 1.

Required:

For Whole Grain Bakery, record the issuance of the note payable on March 1 and the cash payment on September 1. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

14.

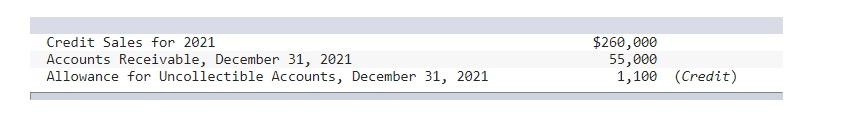

Suzuki Supply reports the following amounts at the end of 2021 (before adjustment).

Required:

1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

15.

2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 3% of credit sales will not be collected. (If no entry is required for a particular transaction/event, select “No Journal Entry Required” in the first account field.)

16.

3. Calculate the effect on net income (before taxes) and total assets in 2021 for each method. Suzuki estimates 12% of receivables and 3% of credit sales respectively will not be collected.