Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homework Chapter 6

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homework Chapter 6

Homework Chapter 6

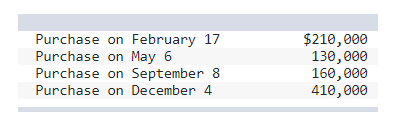

1. Russell Retail Group begins the year with inventory of $55,000 and ends the year with inventory of $45,000. During the year, the company has four purchases for the following amounts.

Required:

Calculate cost of goods sold for the year.

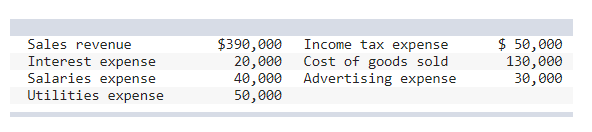

2. Wayman Corporation reports the following amounts in its December 31, 2021, income statement.

Required:

Prepare a multiple-step income statement.

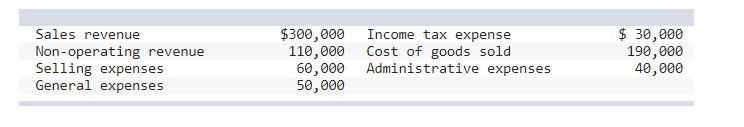

3. Tisdale Incorporated reports the following amount in its December 31, 2021, income statement.

Required:

1. Prepare a multiple-step income statement. (Losses should be indicated by a minus sign.)

4.

2. Tisdale Incorporated does not appear to have much profit-generating potential.

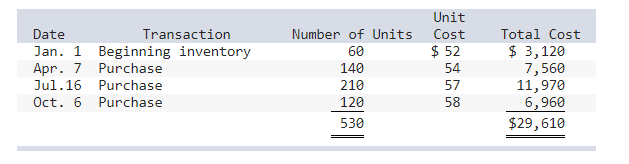

5. During the year, TRC Corporation has the following inventory transactions.

Required:

1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

6.

2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

7.

3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round “Average Cost per unit” to 2 decimal places and all other answers to the nearest whole number.)

8.

4. Determine which method will result in higher profitability when inventory costs are rising.

9. Bingerton Industries uses a perpetual inventory system. The company began the year with inventory of $85,000. Purchases of inventory on account during the year totaled $310,000. Inventory costing $335,000 was sold on account for $520,000.

Required:

Record transactions for the purchase and sale of inventory. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

10. On June 5, Staley Electronics purchases 200 units of inventory on account for $20 each. After closer examination, Staley determines 40 units are defective and returns them to its supplier for full credit on June 9. All remaining inventory is sold on account on June 16 for $35 each.

Required:

Record transactions for the purchase, return, and sale of inventory assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

11.

On June 5, Staley Electronics purchases 200 units of inventory on account for $19 each, with terms 2/10, n/30. Staley pays for the inventory on June 12.

Required:

1. Record transactions for the purchase of inventory and payment on account assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

12

2. Assume payment is made on June 22. Record the payment on account assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

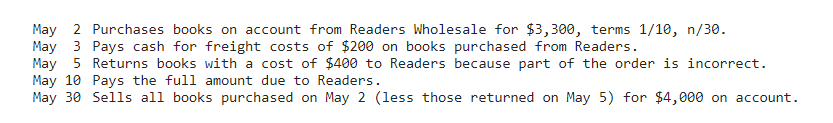

13. Littleton Books has the following transactions during May.

Required:

1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

14.

2. Assume that payment to Readers is made on May 24 instead of May 10. Record this payment. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

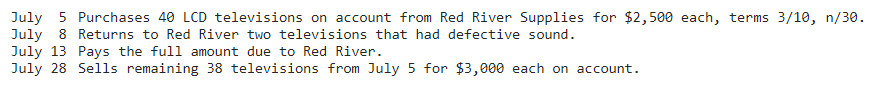

15. Sundance Systems has the following transactions during July.

Required:

Record the transactions of Sundance Systems, assuming the company uses a perpetual inventory system. (If no entry is required for a transaction/event, select “No Journal Entry Required” in the first account field.)

16.

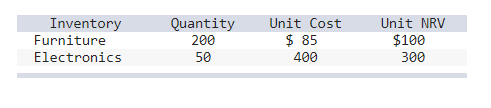

Home Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory.

Required:

1. Calculate the total recorded cost of ending inventory before any adjustments.

17.

2. Calculate ending inventory using the lower of cost and net realizable value.