Navigation » List of Schools, Subjects, and Courses » Accounting 3200A – Intermediate Financial Accounting & Reporting I » Homeworks » Chapter 1 Homework

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Chapter 1 Homework

Chapter 1 Homework

1. Cash flows during the first year of operations for the Harman-Kardon Consulting Company were as follows: Cash collected from customers, $315,000; Cash paid for rent, $35,000; Cash paid to employees for services rendered during the year, $115,000; Cash paid for utilities, $45,000.

In addition, you determine that customers owed the company $55,000 at the end of the year and no bad debts were anticipated. Also, the company owed the gas and electric company $1,500 at year-end, and the rent payment was for a two-year period.

Calculate accrual net income for the year.

2.

For each of the following situations, (1) indicate whether you agree or disagree with the financial reporting practice employed and (2) state the accounting concept that is applied (if you agree), or violated (if you disagree).

- Winderl Corporation did not disclose that it was the defendant in a material lawsuit because the trial was still in progress.

- Alliant Semiconductor Corporation files quarterly and annual financial statements with the SEC.

- Reliant Pharmaceutical paid rent on its office building for the next two years and charged the entire expenditure to rent expense.

- Rockville Engineering records revenue only after products have been shipped, even though customers pay Rockville 50% of the sales price in advance.

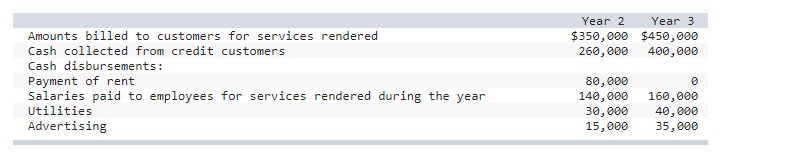

3. Listed below are several transactions that took place during the second and third years of operations for the RPG Company.

In addition, you learn that the company incurred advertising costs of $25,000 in year 2, owed the advertising agency $5,000 at the end of year 1, and there were no liabilities at the end of year 3. Also, there were no anticipated bad debts on receivables, and the rent payment was for a two-year period, year 2 and year 3.

Required:

1. Calculate accrual net income for both years.

2. Determine the amount due the advertising agency that would be shown as a liability on RPG’s balance sheet at the end of year 2.

4.

For each of the items listed below, identify the appropriate financial statement element.

| Item | Element | |

| 1 | Obligation to transfer cash or other resources as a result of a past transaction | |

| 2 | Dividends paid by a corporation to its shareholders | |

| 3 | Inflow of an asset from providing a good or service | |

| 4 | The financial position of a company | |

| 5 | Increase in equity during a period from nonowner transactions | |

| 6 | Increase in equity from peripheral or incidental transaction | |

| 7 | Sale of an asset used in the operations of a business for less than the asset’s book value | |

| 8 | The owners’ residual interest in the assets of a company | |

| 9 | An item owned by the company representing probable future benefits | |

| 10 | Revenues plus gains less expenses and losses. | |

| 11 | An owner’s contribution of cash to a corporation in exchange for ownership shares of stock. | |

| 12 | Outflow of an asset related to the production of revenue. |

5. The conceptual framework indicates the desired fundamental and enhancing qualitative characteristics of accounting information. Several constraints impede achieving these desired characteristics. Answer each of the following questions related to these characteristics and constraints.

| 1 | Which component would allow a large company to record the purchase of a $120 printer as an expense rather than capitalizing the printer as an asset? | |

| 2 | Donald Kirk, former chairman of the FASB, once noted that “. . . there must be public confidence that the standard-setting system is credible, that selection of board members is based on merit and not the influence of special interests . . .” Which characteristic is implicit in Mr. Kirk’s statement? | |

| 3 | Allied Appliances, Inc., changed its revenue recognition policies. Which characteristic is jeopardized by this change? | |

| 4 | National Bancorp, a publicly traded company, files quarterly and annual financial statements with the SEC. Which characteristic is relevant to the timing of these periodic filings? | |

| 5 | In general, relevant information possesses which qualities? | |

| 6 | When there is agreement between a measure or description and the phenomenon it purports to represent, information possesses which characteristic? | |

| 7 | Jeff Brown is evaluating two companies for future investment potential. Jeff’s task is made easier because both companies use the same accounting methods when preparing their financial statements. Which characteristic does the information Jeff will be using possess? | |

| 8 |

A company should disclose information only if the perceived benefits of the disclosure exceed the costs of providing the information. Which constraint does this statement describe? |

6. Listed below are several terms and phrases associated with the accounting concepts. Pair each item from List A with the item from List B that is most appropriately associated with it.

| List A | List B | |

| 1 | Expense Recognition | |

| 2 | Periodicity Assumption | |

| 3 | Historical cost principle | |

| 4 | Materiality | |

| 5 | Revenue Recognition | |

| 6 | Going concern assumption | |

| 7 | Monetary unit assumption | |

| 8 | Economic entity assumption | |

| 9 | Full disclosure principle |

7 Listed below are several statements that relate to financial accounting and reporting. Identify the accounting concept that applies to each statement.

| 1 | Jim Marley is the sole owner of Marley’s Appliances. Jim borrowed $100,000 to buy a new home to be used as his personal residence. This liability was not recorded in the records of Marley’s Appliances. | |

| 2 | Apple Inc. distributes an annual report to its shareholders. | |

| 3 | Hewlett-Packard Corporation depreciates machinery and equipment over their useful lives. | |

| 4 | Crosby Company lists land on its balance sheet at $120,000, its original purchase price, even though the land has a current fair value of $200,000. | |

| 5 | Honeywell International Inc. records revenue when products are delivered to customers, even though the cash has not yet been received. | |

| 6 | Liquidation values are not normally reported in financial statements even though many companies do go out of business | |

| 7 | IBM Corporation, a multibillion dollar company, purchased some small tools at a cost of $800. Even though the tools will be used for a number of years, the company recorded the purchase as an expense. |

8.

For each of the following situations, indicate whether you agree or disagree with the financial reporting practice employed and state the accounting concept that is applied (if you agree) or violated (if you disagree).

Wagner Corporation adjusted the valuation of all assets and liabilities to reflect changes in the purchasing power of the dollar.

Spooner Oil Company changed its method of accounting for oil and gas exploration costs from successful efforts to full cost. No mention of the change was included in the financial statements. The change had a material effect on Spooner’s financial statements.

Cypress Manufacturing Company purchased machinery having a five-year life. The cost of the machinery is being expensed over the life of the machinery.

Rudeen Corporation purchased equipment for $180,000 at a liquidation sale of a competitor. Because the equipment was worth $230,000, Rudeen valued the equipment in its subsequent balance sheet at $230,000.

Davis Bicycle Company received a large order for the sale of 1,000 bicycles at $100 each. The customer paid Davis the entire amount of $100,000 on March 15. However, Davis did not record any revenue until April 17, the date the bicycles were delivered to the customer.

Gigantic Corporation purchased two small calculators at a cost of $32.00. The cost of the calculators was expensed even though they had a three-year estimated useful life.

Esquire Company provides financial statements to external users every three years.

9.

Identify the accounting concept that relates to each statement or phrase below.

| Statement | Accounting Concepts | |

| 1 | Inflation causes a violation of this assumption. | |

| 2 | Information that could affect decision making should be reported. | |

| 3 | Recognizing expenses in the period they were incurred to produce revenue. | |

| 4 | The basis for measurement of many assets and liabilities. | |

| 5 | Relates to the qualitative characteristic of timeliness. | |

| 6 | All economic events can be identified with a particular entity. | |

| 7 | The benefits of providing accounting information should exceed the cost of doing so. | |

| 8 | A consequence is that GAAP need not be followed in all situations. | |

| 9 | Not a qualitative characteristic, but a practical justification for some accounting choices. | |

| 10 | Assumes the entity will continue indefinitely. |