Navigation » List of Schools, Subjects, and Courses » Accounting 3200A – Intermediate Financial Accounting & Reporting I » Homeworks » Chapter 2 Homework

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Chapter 2 Homework

Chapter 2 Homework

1. The following transactions occurred during March 2021 for the Wainwright Corporation. The company owns and operates a wholesale warehouse.

Issued 30,000 shares of common stock in exchange for $300,000 in cash.

Purchased equipment at a cost of $40,000. $10,000 cash was paid and a notes payable to the seller was signed for the balance owed.

Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system.

Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000.

Paid $5,000 in rent on the warehouse building for the month of March.

Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2021.

Paid $70,000 on account for the merchandise purchased in 3.

Collected $55,000 from customers on account.

Recorded depreciation expense of $1,000 for the month on the equipment.

Required:

Analyze each transaction and show the effect of each on the accounting equation for a corporation. (Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.)

2.

The following transactions occurred during March 2021 for the Wainwright Corporation. The company owns and operates a wholesale warehouse.

Issued 30,000 shares of no-par common stock in exchange for $300,000 in cash.

Purchased equipment at a cost of $40,000. $10,000 cash was paid and a notes payable to the seller was signed for the balance owed.

Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system.

Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000.

Paid $5,000 in rent on the warehouse building for the month of March.

Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2021.

Paid $70,000 on account for the merchandise purchased in 3.

Collected $55,000 from customers on account.

Recorded depreciation expense of $1,000 for the month on the equipment.

Prepare journal entries to record each of the transactions listed above. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

3.

The following transactions occurred during the month of June 2021 for the Stridewell Corporation. The company owns and operates a retail shoe store.

Issued 100,000 shares of common stock in exchange for $500,000 cash.

Purchased office equipment at a cost of $100,000. $40,000 was paid in cash and a note payable was signed for the balance owed.

Purchased inventory on account at a cost of $200,000. The company uses the perpetual inventory system.

Credit sales for the month totaled $280,000. The cost of the goods sold was $140,000.

Paid $6,000 in rent on the store building for the month of June.

Paid $3,000 to an insurance company for fire and liability insurance for a one-year period beginning June 1, 2021.

Paid $120,000 on account for the merchandise purchased in 3.

Collected $55,000 from customers on account.

Paid shareholders a cash dividend of $5,000.

Recorded depreciation expense of $2,000 for the month on the office equipment.

Recorded the amount of prepaid insurance that expired for the month.

Required:

Prepare journal entries to record each of the transactions and events listed above. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

4.

The following transactions occurred for the Falwell Company.

- A three-year fire insurance policy was purchased on July 1, 2021, for $12,000. The company debited insurance expense for the entire amount.

- Depreciation on equipment totaled $15,000 for the year.

- Employee salaries of $18,000 for the month of December will be paid in early January 2022.

- On November 1, 2021, the company borrowed $200,000 from a bank. The note requires principal and interest at 12% to be paid on April 30, 2022.

- On December 1, 2021, the company received $3,000 in cash from another company that is renting office space in Falwell’s building. The payment, representing rent for December, January, and February was credited to deferred rent revenue.

- On December 1, 2021, the company received $3,000 in cash from another company that is renting office space in Falwell’s building. The payment, representing rent for December, January, and February was credited to rent revenue rather than deferred rent revenue for $3,000 on December 1, 2021.

Prepare the necessary adjusting entries at December 31, 2021 for each of the above situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

5.

The following transactions occurred for the Microchip Company.

On October 1, 2021, Microchip lent $90,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2022.

On November 1, 2021, the company paid its landlord $6,000 representing rent for the months of November through January. Prepaid rent was debited.

On August 1, 2021, collected $12,000 in advance rent from another company that is renting a portion of Microchip’s factory. The $12,000 represents one year’s rent and the entire amount was credited to deferred rent revenue.

Depreciation on office equipment is $4,500 for the year.

Vacation pay for the year that had been earned by employees but not paid to them or recorded is $8,000. The company records vacation pay as salaries expense.

Microchip began the year with $2,000 in its asset account, supplies. During the year, $6,500 in supplies were purchased and debited to supplies. At year-end, supplies costing $3,250 remain on hand.

Prepare the necessary adjusting entries at December 31, 2021 for each of the above situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

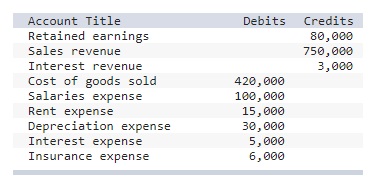

6 American Chip Corporation’s reporting year-end is December 31. The following is a partial adjusted trial balance as of December 31, 2021.

Required:

Prepare the necessary closing entries at December 31, 2021. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)