Navigation » List of Schools, Subjects, and Courses » Accounting 3200A – Intermediate Financial Accounting & Reporting I » Homeworks » Chapter 3 Homework

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Chapter 3 Homework

Chapter 3 Homework

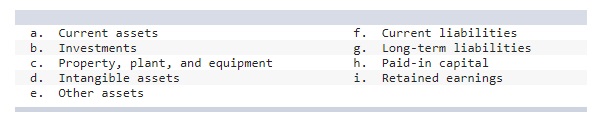

1. The following are the typical classifications used in a balance sheet:

Required:

For each of the following balance sheet items, use the letters above to indicate the appropriate classification category. (If the item is a contra account, select the appropriate letter with a minus sign.)

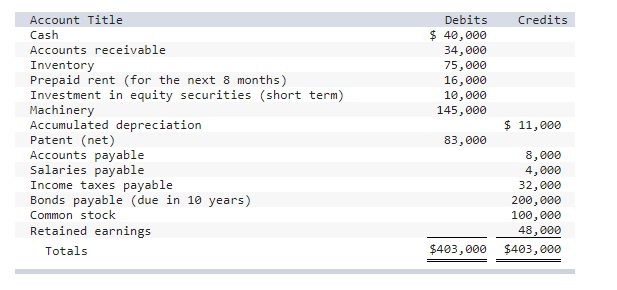

2. The following is a December 31, 2021, post-closing trial balance for the Jackson Corporation.

Required:

Prepare a classified balance sheet for Jackson Corporation at December 31, 2021, by properly classifying each of the accounts. (Amounts to be deducted should be indicated by a minus sign.)

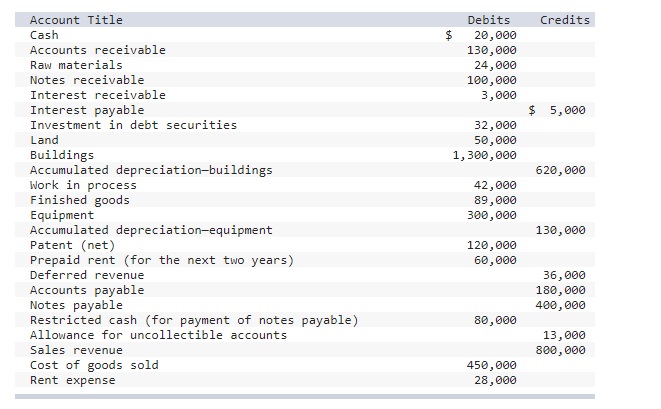

3. Presented below are the ending balances of accounts for the Kansas Instruments Corporation at December 31, 2021.

Additional Information:

The notes receivable, along with any accrued interest, are due on November 22, 2022.

The notes payable are due in 2025. Interest is payable annually.

The investment in debt securities consist of treasury bills, all of which mature next year.

Deferred revenue will be recognized as revenue equally over the next two years.

Required:

Determine the company’s working capital (current assets minus current liabilities) at December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.)

4.

Cone Corporation is in the process of preparing its December 31, 2021, balance sheet. There are some questions as to the proper classification of the following items:

$50,000 in cash restricted in a savings account to pay bonds payable. The bonds mature in 2025.

Prepaid rent of $24,000, covering the period January 1, 2022, through December 31, 2023.

Notes payable of $200,000. The notes are payable in annual installments of $20,000 each, with the first installment payable on March 1, 2022.

Accrued interest payable of $12,000 related to the notes payable.

Investment in equity securities of other corporations, $80,000. Cone intends to sell one-half of the securities in 2022.

Required:

Prepare the asset and liability sections of a classified balance sheet to show how each of the above items should be reported.

5. Listed below are several terms and phrases associated with the balance sheet and financial disclosures. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it.

6.

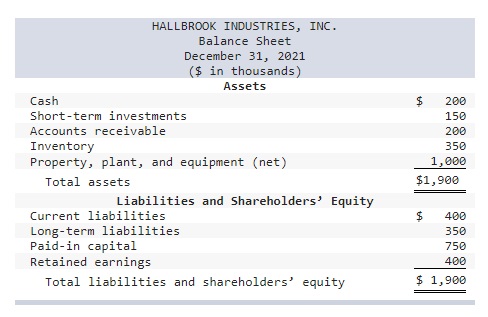

The 2021 balance sheet for Hallbrook Industries, Inc., is shown below

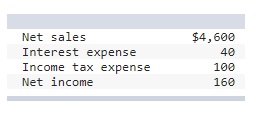

The company’s 2021 income statement reported the following amounts ($ in thousands):

Required:

1. Calculate the current ratio. (Round your answer to 2 decimal places.)

2. Calculate the acid-test ratio. (Round your answer to 3 decimal places.)

3. Calculate the debt to equity ratio. (Round your answer to 2 decimal places.)

4. Calculate the times interest earned ratio. (Round your answer to 1 decimal place.)