Navigation » List of Schools, Subjects, and Courses » Accounting 102 – Managerial Accounting » Assignments » Assignment 2

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Assignment 2

Assignment 2

1. The direct materials required to manufacture each unit of product are listed on a ________.

bill of materials

materials requisition form

materials ticket

job order cost sheet

2. The management of Blue Ocean Company estimates that 50,000 machine-hours will be required to support the production planned for the year. It also estimates $300,000 of total fixed manufacturing overhead cost for the coming year and $4 of variable manufacturing overhead cost per machine-hour. What is the predetermined overhead rate?

$6.00 per machine hour.

$8.00 per machine hour.

$10.00 per machine hour.

$12.50 per machine hour.

3. In the cost formula (Y = a + bX) that is used to estimate the total manufacturing overhead cost for a given period, the letter “a” refers to the estimated ________.

total manufacturing overhead cost

total fixed manufacturing overhead cost

variable manufacturing overhead cost per unit of the allocation base

total amount of the allocation base

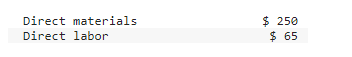

4. Mickley Company’s plantwide predetermined overhead rate is $19.00 per direct labor-hour and its direct labor wage rate is $13.00 per hour. The following information pertains to Job A-500:

Required:

1. What is the total manufacturing cost assigned to Job A-500?

2. If Job A-500 consists of 50 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)

5. A normal cost system applies overhead to jobs ________.

by multiplying a predetermined overhead rate by the estimated amount of the allocation base incurred by the job

by multiplying a predetermined overhead rate by the actual amount of the allocation base incurred by the job

using the actual amount of overhead caused by each job

using the normal amount of overhead caused by each job

6 Companies can improve job cost accuracy by using ________.

a plantwide overhead rate

direct-labor hours to apply overhead

multiple predetermined overhead rates

number of units in the job to apply overhead

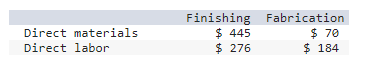

7. Braverman Company has two manufacturing departments—Finishing and Fabrication. The predetermined overhead rates in Finishing and Fabrication are $16.00 per direct labor-hour and 110% of direct materials cost, respectively. The company’s direct labor wage rate is $23.00 per hour. The following information pertains to Job 700:

Required:

1. What is the total manufacturing cost assigned to Job 700?

2. If Job 700 consists of 5 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)

8. Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants that work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients.

Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 95,000 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $1,235,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $1,247,400 and its actual total direct labor was 100,050 hours.

Required:

1. Compute the predetermined overhead rate.

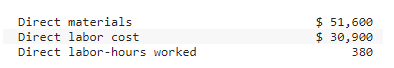

2. During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available with respect to this job:

Compute the total job cost for the Xavier Company engagement.

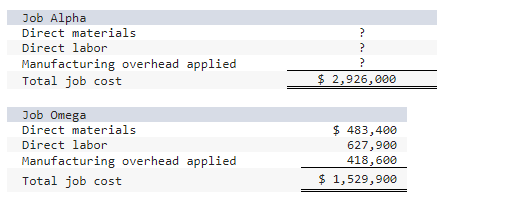

9. Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $21.00 per hour. During the year, the company started and completed only two jobs—Job Alpha, which used 69,500 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below:

Required:

1. Calculate the plantwide predetermined overhead rate.

2. Complete the job cost sheet for Job Alpha.

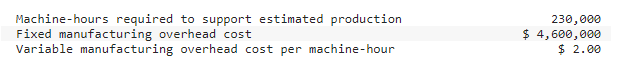

10. Taveras Corporation is currently operating at 50% of its available manufacturing capacity. It uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates:

Required:

1. Compute the plantwide predetermined overhead rate.

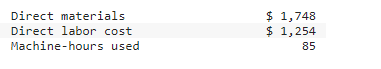

2. During the year, Job P90 was started, completed, and sold to the customer for $3,800. The following information was available with respect to this job:

Compute the total manufacturing cost assigned to Job P90.

11. What is the term used when a company applies less overhead to production than it actually incurs?

Misapplied

Overapplied

Unadjusted

Underapplied

Knowledge Check 02

The adjustment for overapplied overhead ________.

decreases cost of goods sold and decreases net operating income.

decreases cost of goods sold and increases net operating income.

increases cost of goods sold and decreases net operating income.

increases cost of goods sold and increases net operating income.

Knowledge Check 03

When all of a company’s job cost sheets are viewed collectively they form what is known as a ________.

general ledger

inventory

job-order costing system

subsidiary ledger