Navigation » List of Schools, Subjects, and Courses » Accounting 102 – Managerial Accounting » Assignments » Assignment 4

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Assignment 4

Assignment 4

1. Which of the following is a reason for the popularity of plantwide overhead rates to allocate overhead costs?

multiple choice

Simplicity

Traceability

Accuracy

Lower allocation base

2. In an activity-based costing system, _____________ expresses how much of the activity is carried out and is used as the allocation base for assigning overhead costs

3. Which of the following are part of the four-level hierarchy used in activity-based costing systems? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

Batch-level activities

Company-wide activities

Facility-level activities

Overhead activities

Product-level activities

Unit-level activities.

4. Which of the following is a product-level activity?

multiple choice

Processing units by hand

General factory administration

Processing purchase orders

Administering parts inventories

5. The following activities occur at Greenwich Corporation, a company that manufactures a variety of products:

Required:

Classify each of the activities below as either a unit-level, batch-level, product-level, or facility-level activity.

| Activity | Activity Classification |

| a. Various individuals manage the parts inventories. | |

| b. A clerk in the factory issues purchase orders for a job. | |

| c. The personnel department trains new production workers. | |

| d. The factory’s general manager meets with other department heads to coordinate plans. | |

| e. Direct labor workers assemble products. | |

| f. Engineers design new products. | |

| g. The materials storekeeper issues raw materials to be used in jobs. | |

| h. The maintenance department performs periodic preventive maintenance on general-use equipment. |

6. Under an ABC system, overhead costs are allocated to the products using a two-stage process. What happens during the second stage of that process?

We allocate the overhead costs to individual activity pools.

We allocate the costs in the activity pools to the products using activity rates and activity measures. Correct

We identify the activity pools.

We calculate the activity rate for each activity pool.

7. Helio Company has two products: A and B. The annual production and sales of Product A is 1,850 units and of Product B is 1,250 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $100,485. What is the company’s predetermined overhead rate?

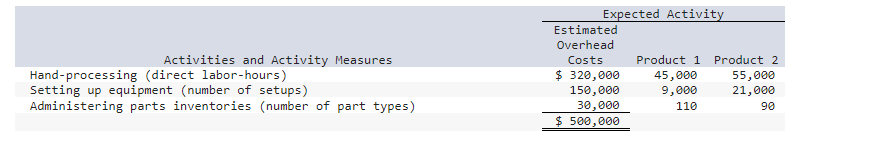

8.

Transformation Corporation has provided the information set forth above regarding the overhead to be allocated between the two products it produces: CDE and EFG. What is the activity rate for the hand-processing units activity?

$3.20 per setup

$5.00 per setup

$150.00 per part-type

$3.20 per direct labor-hour

9. Rustafson Corporation is a diversified manufacturer of consumer goods. The company’s activity-based costing system has the following seven activity cost pools:

Activity Cost Pool Estimated Overhead Cost Expected Activity

Labor-related $ 21,200 5,000 direct labor-hours

Machine-related $ 2,000 8,000 machine-hours

Machine setups $ 48,000 1,000 setups

Production orders $ 9,800 200 orders

Product testing $ 22,800 600 tests

Packaging $ 64,600 3,800 packages

General factory $ 56,000 5,000 direct labor-hours

2. Compute the company’s predetermined overhead rate, assuming that the company uses a single plantwide predetermined overhead rate based on direct labor-hours. (Round your answer to 2 decimal places.)

10. Activities Activity Rates

Assembly $ 14.35 per machine-hour

Processing Orders $ 47.85 per order

inspection $ 70.30 per inspection-hour

True Blue Corporation provided the data set forth above from its activity-based costing system. The company makes 430 units of product D28K a year, requiring a total of 690 machine-hours, 40 orders, and 10 inspection-hours per year. The product’s direct materials cost is $35.82 per unit and its direct labor cost is $29.56 per unit. What is the unit product cost of product D28K? (Round your answer to 2 decimal places.)

11. Harrington Company has two products: A and B. The annual production and sales of Product A is 1,750 units and of Product B is 1,150 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.7 direct labor-hours per unit. The predetermined overhead rate is $66.00 per direct labor-hour. What it the amount of overhead cost that will be allocated to each unit of Product B? (Round your answer to 2 decimal places.)

12.

Implementing an activity-based costing system often results in a shift of overhead costs from:

overpriced to underpriced products.

unit-level to batch-level activities.

high-volume to low-volume products.

low-volume to high-volume products.

13. Activity-based management involves focusing on activities to:

avoid cost shifts due to the use of activity-based costing.

identify a single allocation base that causes overhead costs.

decrease the cost of implementing an activity-based costing system.

eliminate waste, decrease processing time, and reduce defects.

14. Activity-based costing improves accuracy of product costs by:

using multiple-activity pools to accumulate overhead costs.

relying on a single measure that causes overhead costs.

implementing absorption costing approach for decision-making purposes.

using departmental overhead rates that vary by process.

15. Larner Corporation is a diversified manufacturer of industrial goods. The company’s activity-based costing system contains the following six activity cost pools and activity rates:

Activity Cost Pool Activity Rates

Labor-related $ 8.00 per direct labor-hour

Machine-related $ 9.00 per machine-hour

Machine setups $ 50.00 per setup

Production orders $ 100.00 per order

Shipments $ 180.00 per shipment

General factory $ 9.00 per direct labor-hour

Cost and activity data have been supplied for the following products:

J78 B52

Direct materials cost per unit $ 4.50 $ 45.00

Direct labor cost per unit $ 4.75 $ 10.00

Number of units produced per year 4,000 500

Total Expected Activity

J78 B52

Direct labor-hours 900 50

Machine-hours 2,900 20

Machine setups 4 4

Production orders 8 4

Shipments 12 4

Required:

Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

16.

Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product H is expected to sell 37,000 units next year and Product L is expected to sell 7,400 units. A unit of either product requires 0.4 direct labor-hours.

The company’s total manufacturing overhead for the year is expected to be $1,509,600.

Required:

1-a. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product?

1-b. Compute the total amount of overhead cost that would be applied to each product.

2. Management is considering an activity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $754,800 assigned to Product H and $754,800 assigned to Product L.

If this suggestion is followed, how much overhead cost per unit would be assigned to each product?

17.

Gino’s Restaurant is a popular restaurant in Boston, Massachusetts. The owner of the restaurant has been trying to better understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation with the owner, identified the following major activities:

Activity Cost Pool Activity Measure

Serving a party of diners Number of parties served

Serving a diner Number of diners served

Serving drinks Number of drinks ordered

A group of diners who ask to sit at the same table is counted as a party. Some costs, such as the costs of cleaning linen, are the same whether one person is at a table or the table is full. Other costs, such as washing dishes, depend on the number of diners served.

Data concerning these activities are shown below:

Serving a Party Serving a Diner Serving Drinks Total

Total cost $ 19,000 $ 112,000 $ 91,800 $ 222,800

Total activity 5,000 parties 20,000 diners 51,000 drinks

Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant. She knew that the total cost for the month was $222,800 and that 20,000 diners had been served. Therefore, the average cost per diner was $11.14 ($222,800 ÷ 20,000 diners = $11.14 per diner).

Required:

1. Compute the activity rates for each of the three activities.

2. According to the activity-based costing system, what is the total cost of serving each of the following parties of diners?

a. A party of four diners who order three drinks in total.

b. A party of two diners who do not order any drinks.

c. A lone diner who orders two drinks.

3. Convert the total costs you computed in part (2) above to costs per diner. In other words, what is the average cost per diner for serving each of the following parties?

a. A party of four diners who order three drinks in total.

b. A party of two diners who do not order any drinks.

c. A lone diner who orders two drinks.