Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 4 » Quiz 4 Sample Answers

Quiz 4

1. McGregor Company allows customers to pay with credit cards. The credit card company charges McGregor 4% of the sale. When a customer uses a credit card to pay McGregor $1,400 for services provided, McGregor would:

- Debit cash for $1,400.

- Credit service revenue for $1,456.

- Credit service revenue for $1,344.

- Debit service fee expense for $56.

2. A customer makes a $2,200 purchase at ApplianceWorld, paying with a credit card. ApplianceWorld is charged a 2% fee by the credit card company. When recording this sale, ApplianceWorld would:

- Credit Sales Revenue for $2,200.

- Debit Accounts Receivable for $2,200.

- Credit Deferred Revenue for $2,200.

- Credit Sales Revenue for $2,156

3.

On May 31, Money Corporation’s Cash account showed a balance of $14,000 before the bank reconciliation was prepared. After examining the May bank statement and items included with it, the company’s accountant found the following items:

Error: Money Corp. wrote a check for $95 but recorded it incorrectly for $950.

What is the amount of cash that should be reported in the company’s balance sheet as of May 31?

- $14,525.

- $14,250.

- $12,625.

- $13,670.

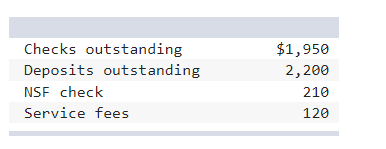

4. The following information was taken from a company’s bank reconciliation at the end of the year:

What is the correct cash balance that should be reported in the company’s balance sheet at the end of the year?

$6,000.

$5,963.

$10,640.

$8,740.

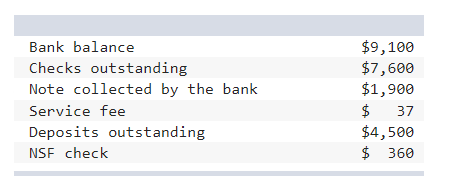

5. The balance in a company’s Cash account on August 31 was $19,500 before the bank reconciliation was prepared. After examining the August bank statement and items included with it, the company’s accountant found:

What is the amount of cash that should be reported in the balance sheet as of August 31?

Multiple Choice

$19,000.

$19,080.

$20,800.

$20,630.

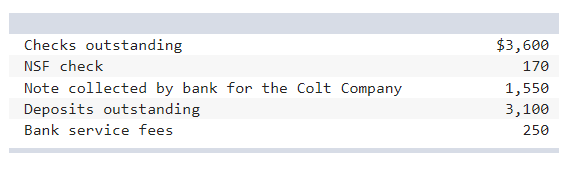

6. The balance shown in the August bank statement of a company was $22,500. After examining the August bank statement and items included with it, the company’s accountant found:

What is the amount of cash that should be reported in the balance sheet as of August 31?

$16,400.

$15,400.

$23,500.

$19,900.

7. At the time a $350 petty cash fund is being replenished, the company’s accountant finds vouchers totaling $300 and petty cash of $50. The vouchers include: postage, $70; business lunches, $105; delivery fees, $90; and office supplies, $35. Which of the following is not recorded when recognizing expenditures from the petty cash fund?

Credit Cash, $300.

Debit Cash, $300.

Debit Postage Expense, $70.

Debit Supplies, $35.

8. The three elements of the fraud triangle are:

Motivation.

Rationalization.

Opportunity.

All of the other answers are elements of the fraud triangle.

9. The component of internal control that includes the policies and procedures that help ensure that management’s directives are being carried out is:

Monitoring.

Information and communication.

Risk assessment.

Control activities.

10. What is the concept behind separation of duties in establishing internal controls?

The company’s financial accountant should not share information with the company’s tax accountant.

Duties of middle-level managers should be clearly separated from those of top executives.

Employee fraud is less likely to occur when access to assets and access to accounting records are separated.

The external auditors of the company should have no contact with managers while the audit is taking place.

Quiz 4 Answers

1.