Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 10 » Quiz 10 Sample Answers

Quiz 10

1. A company issued 1,500 shares of $6 par value preferred stock for $7 per share. What is true about the journal entry to record the issuance?

Debit Preferred Stock $10,500

Credit Cash $10,500

Credit Preferred Stock $10,500

Credit Additional Paid-In Capital $1,500

2. Roberto Designers was organized on January 1, 2021. The firm was authorized to issue 190,000 shares of $6 par value common stock. During 2021, Roberto had the following transactions relating to stockholders’ equity:

Issued 19,000 shares of common stock at $8 per share.

Issued 38,000 shares of common stock at $9 per share.

Reported a net income of $190,000.

Paid dividends of $95,000.

Purchased 2,500 shares of treasury stock at $11 (part of the 38,000 shares issued at $9).

What is total stockholders’ equity at the end of 2021?

$599,500.

$561,500.

$1,055,500.

$1,245,500.

3. Clothing Emporium was organized on January 1, 2021. The firm was authorized to issue 190,000 shares of $8 par value common stock. During 2021, Clothing Emporium had the following transactions relating to stockholders’ equity:

Issued 57,000 shares of common stock at $10 per share.

Issued 38,000 shares of common stock at $11 per share.

Reported a net income of $190,000.

Paid dividends of $95,000.

What is total paid-in capital at the end of 2021?

$893,000.

$1,178,000.

$988,000.

$1,083,000.

4. The ending Retained Earnings balance of Lambert Inc. increased by $2.1 million from the beginning of the year. The company’s net income earned during the year is $6.3 million. What is the amount of dividends Lambert Inc. declared and paid?

Multiple Choice

$8.4 million.

$2.1 million.

$6.3 million.

$4.2 million.

5 The board of directors of Capstone Inc. declared a $0.50 per share cash dividend on its $3 par common stock. On the date of declaration, there were 45,000 shares authorized, 16,000 shares issued, and 5,000 shares held as treasury stock.

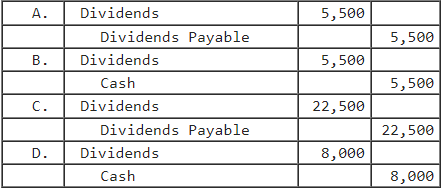

What is the entry when the dividends are declared?

Option C

Option A

Option D

Option B

6. On February 22, Brett Corporation acquired 200 shares of its $3 par value common stock for $26 each. On March 15, the company resold 65 shares for $29 each. What is true of the entry for reselling the shares?

Multiple Choice

Debit Treasury Stock $1,690

Credit Additional Paid–in Capital $195

Credit Cash $1,690

Credit Treasury Stock $1,885

7. Fashion, Inc. had a Retained Earnings balance of $17,000 at December 31, 2021. The company had an average income of $6,500 over the next 2 years, and an ending Retained Earnings balance of $11,000 at December 31, 2023. What was the total amount of dividends paid over the last two years?

$18,250.

$20,500.

$22,000.

$19,000.

8. When a company issues 36,000 shares of $2 par value common stock for $20 per share, the journal entry for this issuance would include:

Multiple Choice

A credit to Common Stock for $720,000.

A credit to Additional Paid-in Capital for $648,000.

A debit to Additional Paid-in Capital for $72,000.

A debit to Cash for $72,000.

9. On December 2, Coley Corp. acquired 2,000 shares of its $4 par value common stock for $23 each.

On December 20, Coley Corp. resold 1,600 shares for $13 each. Which of the following is correct regarding the journal entry for the resold shares?

Credit Additional Paid–in Capital $14,400

Credit Treasury Stock $20,800

Credit Treasury Stock $36,800

Debit Cash $26,000

10. South Beach Apparel issued 16,000 shares of $1 par value stock for $5 per share. What is true about the journal entry to record the issuance?

Multiple Choice

Credit Additional Paid-In Capital $64,000

Debit Common Stock $16,000

Credit Additional Paid-in Capital $16,000

Credit Common Stock $80,000

Quiz 10 Answers

1. A company issued 1,500 shares of $6 par value preferred stock for $7 per share. What is true about the journal entry to record the issuance?

Debit Preferred Stock $10,500

Credit Cash $10,500

Credit Preferred Stock $10,500

Credit Additional Paid-In Capital $1,500

Answer: Credit Additional Paid-In Capital $1,500