Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homeworks Chapter 1

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Homeworks Chapter 1

Homeworks Chapter 1

1. Exercise 1-4A Calculate net income and stockholders’ equity (LO1-2)

Eagle Corp. operates Magnetic Resonance Imaging (MRI) clinics throughout the Northeast. At the end of the current period, the company reports the following amounts: Assets = $50,000; Liabilities = $27,000; Dividends = $3,000; Revenues = $14,000; Expenses = $9,000.

Required:

Calculate net income.

Calculate stockholders’ equity at the end of the period.

2. Exercise 1-5A Calculate net loss and stockholders’ equity (LO1-2)

Cougar’s Accounting Services provides low-cost tax advice and preparation to those with financial need. At the end of the current period, the company reports the following amounts: Assets = $19,000; Liabilities = $15,000; Revenues = $28,000; Expenses = $33,000.

Required:

Calculate net loss.

Calculate stockholders’ equity at the end of the period.

3.

Exercise 1-6A Prepare an income statement (LO1-3)

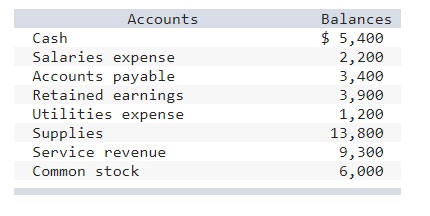

Below are the account balances for Cowboy Law Firm at the end of December.

Required:

Use only the appropriate accounts to prepare an income statement.

4. Exercise 1-7A Prepare a statement of stockholders’ equity (LO1-3)

At the beginning of the year (January 1), Buffalo Drilling has $11,000 of common stock outstanding and retained earnings of $8,200. During the year, Buffalo reports net income of $8,500 and pays dividends of $3,200. In addition, Buffalo issues additional common stock for $8,000.

Required:

Prepare the statement of stockholders’ equity at the end of the year (December 31).

5. Exercise 1-8A Prepare a balance sheet (LO1-3)

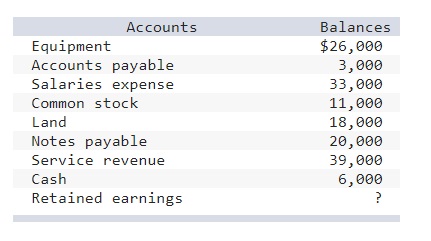

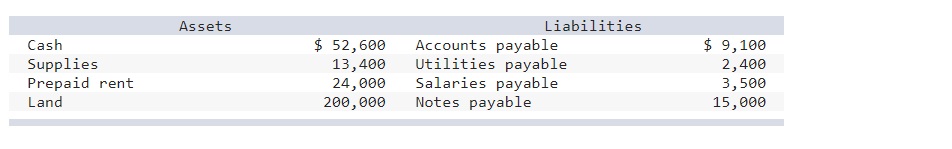

Wolfpack Construction has the following account balances at the end of the year.

Required:

Use only the appropriate accounts to prepare a balance sheet.

6.

Exercise 1-9A Prepare a statement of cash flows (LO1-3)

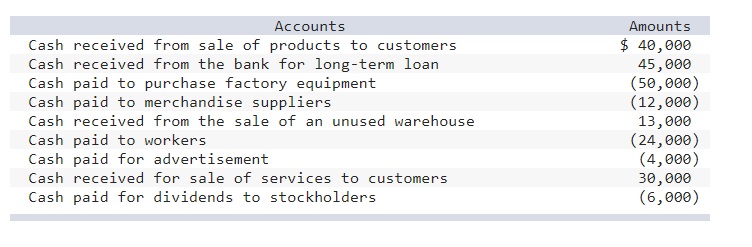

Tiger Trade has the following cash transactions for the period.

Assume the balance of cash at the beginning of the period is $5,000.

Required:

1. Calculate the ending balance of cash.

2. Prepare a statement of cash flows. (Cash outflows should be indicated by a minus sign.)

7. Exercise 1-10A Link the income statement to the statement of stockholders’ equity (LO1-3)

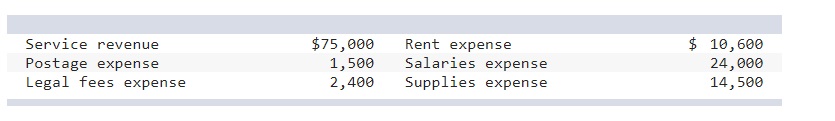

On December 31, 2021, Fighting Okra Cooking Services reports the following revenues and expenses.

In addition, the balance of common stock at the beginning of the year was $200,000, and the balance of retained earnings was $32,000. During the year, the company issued additional shares of common stock for $25,000 and paid dividends of $10,000.

Required:

Prepare an income statement.

Prepare a statement of stockholders’ equity.

8. Exercise 1-11A Link the statement of stockholders’ equity to the balance sheet (LO1-3)

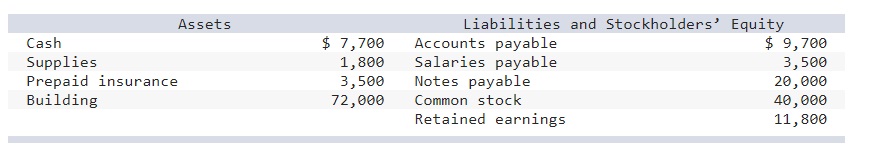

At the beginning of 2021, Artichoke Academy reported a balance in common stock of $150,000 and a balance in retained earnings of $50,000. During the year, the company issued additional shares of stock for $40,000, earned net income of $30,000, and paid dividends of $10,000. In addition, the company reported balances for the following assets and liabilities on December 31.

Required:

Prepare a statement of stockholders’ equity.

Prepare a balance sheet.

9.

Exercise 1-12A Link the balance sheet to the statement of cash flows (LO1-3)

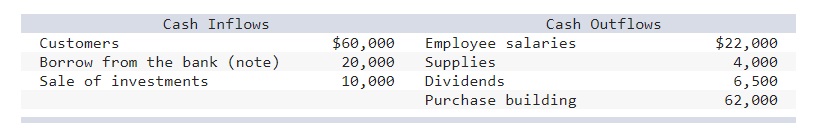

Squirrel Tree Services reports the following amounts on December 31, 2021.

In addition, the company reported the following cash flows.

Required:

Prepare a balance sheet.

Prepare a statement of cash flows.

10 Exercise 1-14A Calculate the balance of retained earnings (LO1-3)

During its first five years of operations, Red Raider Consulting reports net income and pays dividends as follows.

Required:

Calculate the balance of retained earnings at the end of each year. Note that retained earnings will always equal $0 at the beginning of year 1.