Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Homeworks » Homeworks Chapter 1 » Homeworks Chapter 1 Sample Answers

Homeworks Chapter 1

1. Exercise 1-4A Calculate net income and stockholders’ equity (LO1-2)

Eagle Corp. operates Magnetic Resonance Imaging (MRI) clinics throughout the Northeast. At the end of the current period, the company reports the following amounts: Assets = $50,000; Liabilities = $27,000; Dividends = $3,000; Revenues = $14,000; Expenses = $9,000.

Required:

Calculate net income.

Calculate stockholders’ equity at the end of the period.

2. Exercise 1-5A Calculate net loss and stockholders’ equity (LO1-2)

Cougar’s Accounting Services provides low-cost tax advice and preparation to those with financial need. At the end of the current period, the company reports the following amounts: Assets = $19,000; Liabilities = $15,000; Revenues = $28,000; Expenses = $33,000.

Required:

Calculate net loss.

Calculate stockholders’ equity at the end of the period.

3.

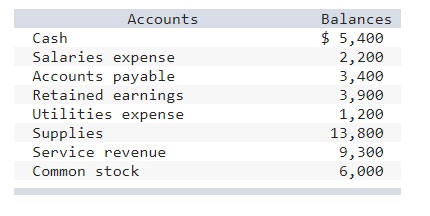

Exercise 1-6A Prepare an income statement (LO1-3)

Below are the account balances for Cowboy Law Firm at the end of December.

Required:

Use only the appropriate accounts to prepare an income statement.

4. Exercise 1-7A Prepare a statement of stockholders’ equity (LO1-3)

At the beginning of the year (January 1), Buffalo Drilling has $11,000 of common stock outstanding and retained earnings of $8,200. During the year, Buffalo reports net income of $8,500 and pays dividends of $3,200. In addition, Buffalo issues additional common stock for $8,000.

Required:

Prepare the statement of stockholders’ equity at the end of the year (December 31).

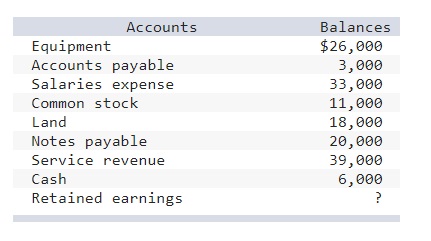

5. Exercise 1-8A Prepare a balance sheet (LO1-3)

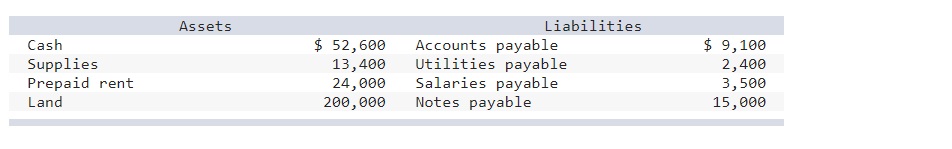

Wolfpack Construction has the following account balances at the end of the year.

Required:

Use only the appropriate accounts to prepare a balance sheet.

6.

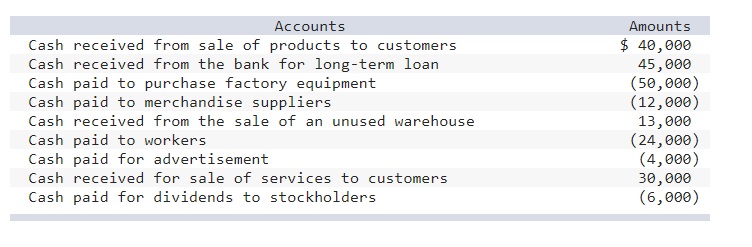

Exercise 1-9A Prepare a statement of cash flows (LO1-3)

Tiger Trade has the following cash transactions for the period.

Assume the balance of cash at the beginning of the period is $5,000.

Required:

1. Calculate the ending balance of cash.

2. Prepare a statement of cash flows. (Cash outflows should be indicated by a minus sign.)

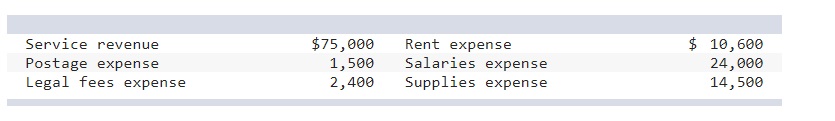

7. Exercise 1-10A Link the income statement to the statement of stockholders’ equity (LO1-3)

On December 31, 2021, Fighting Okra Cooking Services reports the following revenues and expenses.

In addition, the balance of common stock at the beginning of the year was $200,000, and the balance of retained earnings was $32,000. During the year, the company issued additional shares of common stock for $25,000 and paid dividends of $10,000.

Required:

Prepare an income statement.

Prepare a statement of stockholders’ equity.

8. Exercise 1-11A Link the statement of stockholders’ equity to the balance sheet (LO1-3)

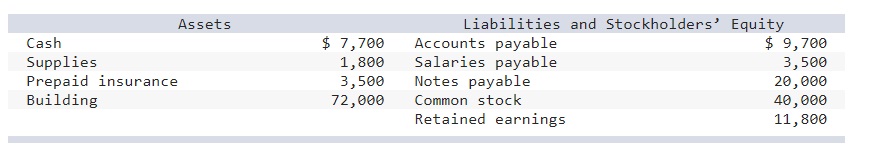

At the beginning of 2021, Artichoke Academy reported a balance in common stock of $150,000 and a balance in retained earnings of $50,000. During the year, the company issued additional shares of stock for $40,000, earned net income of $30,000, and paid dividends of $10,000. In addition, the company reported balances for the following assets and liabilities on December 31.

Required:

Prepare a statement of stockholders’ equity.

Prepare a balance sheet.

9.

Exercise 1-12A Link the balance sheet to the statement of cash flows (LO1-3)

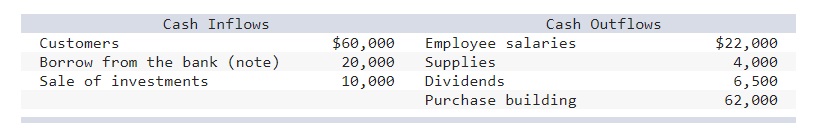

Squirrel Tree Services reports the following amounts on December 31, 2021.

In addition, the company reported the following cash flows.

Required:

Prepare a balance sheet.

Prepare a statement of cash flows.

10 Exercise 1-14A Calculate the balance of retained earnings (LO1-3)

During its first five years of operations, Red Raider Consulting reports net income and pays dividends as follows.

Required:

Calculate the balance of retained earnings at the end of each year. Note that retained earnings will always equal $0 at the beginning of year 1.

Homeworks Chapter 1