Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 5

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Quiz 5

Quiz 5

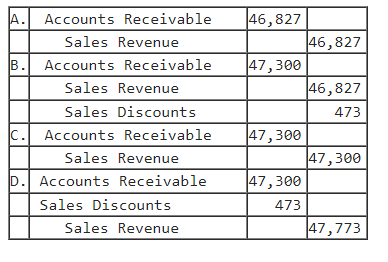

1. Oswego Clay Pipe Company provides services of $47,300 to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. What would Oswego record on April 12?

Option A

Option B

Option C

Option D

2. At December 31, Gill Co. reported accounts receivable of $262,000 and an allowance for uncollectible accounts of $700 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. The amount of the adjustment for uncollectible accounts would be:

$10,480.

$10,290.

$700.

$9,780.

3. At December 31, Gill Co. reported accounts receivable of $228,000 and an allowance for uncollectible accounts of $1,400 (debit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 1% of accounts receivable. The amount of the adjustment for uncollectible accounts would be:

$2,280.

$880.

$1,400.

$3,680.

4. At December 31, Amy Jo’s Appliances had account balances in Accounts Receivable of $318,000 and in Allowance for Uncollectible Accounts of $820 (credit) before any adjustments. An analysis of Amy Jo’s December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. Bad debt expense for the year should be:

$12,401.

$12,720.

$11,900.

$13,540.

5. At December 31, Amy Jo’s Appliances had account balances in Accounts Receivable of $380,000 and in Allowance for Uncollectible Accounts of $1,460 (debit) before any adjustments. An analysis of Amy Jo’s December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. Bad debt expense for the year should be:

$9,060.

$1,460.

$7,561.

$6,140.

6. On December 31, 2021, Coolwear Inc. had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $46,500 and $2,100, respectively. During 2022, Coolwear wrote off $575 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $4,800 at December 31, 2022. Bad debt expense for 2022 would be:

$2,775.

$7,475.

$3,275.

$575.

7. On December 31 , 2021, Larry’s Used Cars had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $53,000 and $825, respectively. During 2022, Larry’s wrote off $1,550 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $5,700 at December 31, 2022. Bad debt expense for 2022 would be:

$6,425.

$825.

$4,975.

$5,700.

8. Crimson Inc. recorded credit sales of $763,000, of which $580,000 is not yet due, $110,000 is past due for up to 180 days, and $73,000 is past due for more than 180 days. Under the aging of receivables method, Crimson Inc. expects it will not collect 4% of the amount not yet due, 17% of the amount past due for up to 180 days, and 21% of the amount past due for more than 180 days. The allowance account had a debit balance of $1,900 before adjustment. After adjusting for bad debt expense, what is the ending balance of the allowance account?

$57,230.

$66,330.

$23,200.

$59,130.

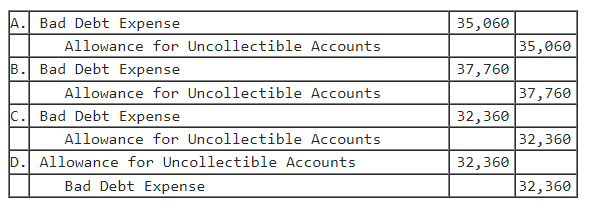

9 During the year, Bears Inc. recorded credit sales of $530,000. Before adjustments at year-end, Bears has accounts receivable of $390,000, of which $53,000 is past due, and the allowance account had a credit balance of $2,700. Using the aging of receivables method, what would be the adjustment assuming Bears expects it will not collect 6% of the amount not yet past due and 28% of the amount past due?

Option A

Option B

Option C

Option D

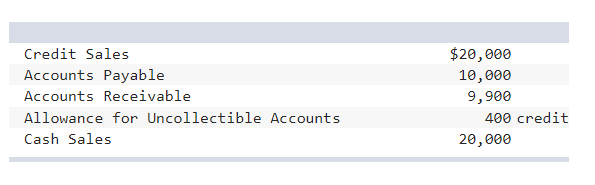

10 The following information pertains to Lightning Inc., at the end of December:

Lightning uses the aging method and estimates it will not collect 7% of accounts receivable not yet due, 15% of receivables up to 30 days past due, and 41% of receivables greater than 30 days past due. The accounts receivable balance of $9,900 consists of $6,500 not yet due, $1,600 up to 30 days past due, and $1,800 greater than 30 days past due. What is the appropriate amount of Bad Debt Expense?

$400.

$240.

$1,074.

$1,033.