Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 5 » Quiz 5 Sample Answers

Quiz 5

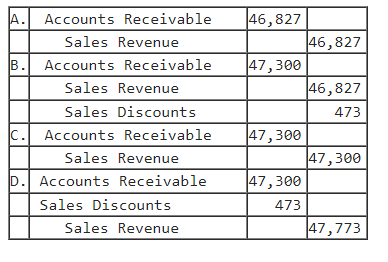

1. Oswego Clay Pipe Company provides services of $47,300 to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. What would Oswego record on April 12?

Option A

Option B

Option C

Option D

2. At December 31, Gill Co. reported accounts receivable of $262,000 and an allowance for uncollectible accounts of $700 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. The amount of the adjustment for uncollectible accounts would be:

$10,480.

$10,290.

$700.

$9,780.

3. At December 31, Gill Co. reported accounts receivable of $228,000 and an allowance for uncollectible accounts of $1,400 (debit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 1% of accounts receivable. The amount of the adjustment for uncollectible accounts would be:

$2,280.

$880.

$1,400.

$3,680.

4. At December 31, Amy Jo’s Appliances had account balances in Accounts Receivable of $318,000 and in Allowance for Uncollectible Accounts of $820 (credit) before any adjustments. An analysis of Amy Jo’s December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. Bad debt expense for the year should be:

$12,401.

$12,720.

$11,900.

$13,540.

5. At December 31, Amy Jo’s Appliances had account balances in Accounts Receivable of $380,000 and in Allowance for Uncollectible Accounts of $1,460 (debit) before any adjustments. An analysis of Amy Jo’s December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. Bad debt expense for the year should be:

$9,060.

$1,460.

$7,561.

$6,140.

6. On December 31, 2021, Coolwear Inc. had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $46,500 and $2,100, respectively. During 2022, Coolwear wrote off $575 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $4,800 at December 31, 2022. Bad debt expense for 2022 would be:

$2,775.

$7,475.

$3,275.

$575.

7. On December 31 , 2021, Larry’s Used Cars had balances in Accounts Receivable and Allowance for Uncollectible Accounts of $53,000 and $825, respectively. During 2022, Larry’s wrote off $1,550 in accounts receivable and determined that there should be an allowance for uncollectible accounts of $5,700 at December 31, 2022. Bad debt expense for 2022 would be:

$6,425.

$825.

$4,975.

$5,700.

8. Crimson Inc. recorded credit sales of $763,000, of which $580,000 is not yet due, $110,000 is past due for up to 180 days, and $73,000 is past due for more than 180 days. Under the aging of receivables method, Crimson Inc. expects it will not collect 4% of the amount not yet due, 17% of the amount past due for up to 180 days, and 21% of the amount past due for more than 180 days. The allowance account had a debit balance of $1,900 before adjustment. After adjusting for bad debt expense, what is the ending balance of the allowance account?

$57,230.

$66,330.

$23,200.

$59,130.

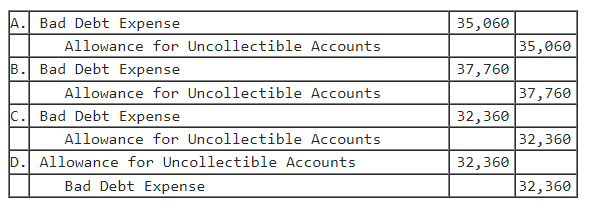

9 During the year, Bears Inc. recorded credit sales of $530,000. Before adjustments at year-end, Bears has accounts receivable of $390,000, of which $53,000 is past due, and the allowance account had a credit balance of $2,700. Using the aging of receivables method, what would be the adjustment assuming Bears expects it will not collect 6% of the amount not yet past due and 28% of the amount past due?

Option A

Option B

Option C

Option D

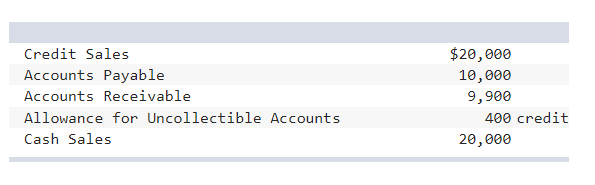

10 The following information pertains to Lightning Inc., at the end of December:

Lightning uses the aging method and estimates it will not collect 7% of accounts receivable not yet due, 15% of receivables up to 30 days past due, and 41% of receivables greater than 30 days past due. The accounts receivable balance of $9,900 consists of $6,500 not yet due, $1,600 up to 30 days past due, and $1,800 greater than 30 days past due. What is the appropriate amount of Bad Debt Expense?

$400.

$240.

$1,074.

$1,033.

Quiz 5 Answers