Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 6

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Quiz 6

Quiz 6

1 A company has beginning inventory for the year of $10,500. During the year, the company purchases inventory for $150,000 and ends the year with $27,000 of inventory. The company will report cost of goods sold equal to:

$166,500.

$177,000.

$133,500.

$150,000.

2. Tyler Toys has beginning inventory for the year of $19,700. During the year, Tyler purchases inventory for $234,000 and has cost of goods sold equal to $238,000. Tyler’s ending inventory equals:

Multiple Choice

$23,700.

$20,000.

$19,700.

$15,700.

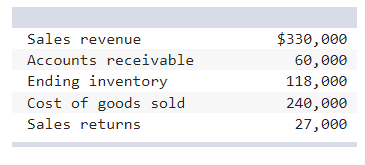

3. Given the information below, what is the gross profit?

Multiple Choice

$66,000.

$185,000.

$90,000.

$63,000.

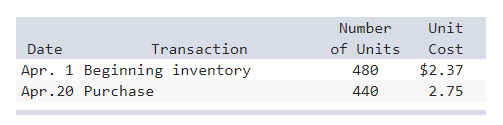

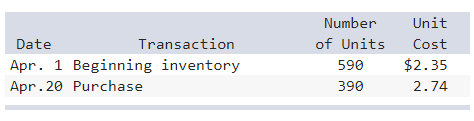

4. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 570 units of inventory during the month. Ending inventory assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$963.

$1,320.

$1,138.

$829.

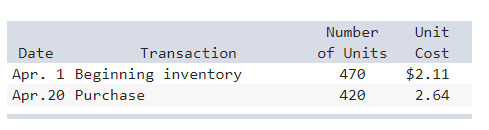

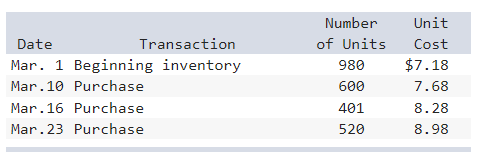

5. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 600 units of inventory during the month. Ending inventory assuming LIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$992.

$612

$766.

$1,109.

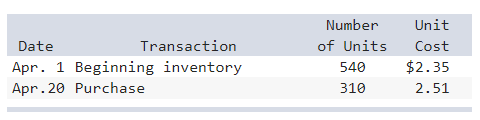

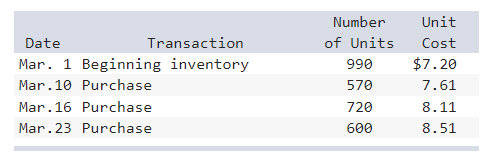

6. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 670 units of inventory during the month. Cost of goods sold assuming LIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$1,574.

$1,084.

$1,624.

$1595

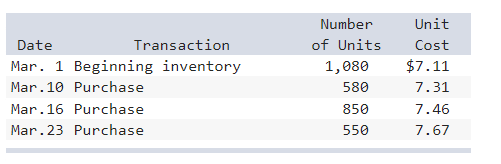

7. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 590 units of inventory during the month. Ending inventory assuming weighted-average cost would be: (Round weighted-average unit cost to 4 decimal places and final answer to the nearest dollar amount.)

Multiple Choice

$993.

$956.

$1,067.

$977.

8. Inventory records for Marvin Incorporated revealed the following:

Marvin sold 1,860 units of inventory during the month. Ending inventory assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$1,282.

$5,671

$2,402.

$7,036.

9. Inventory records for Marvin Company revealed the following:

Marvin sold 1,980 units of inventory during the month. Cost of goods sold assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$16,722.

$16,850.

$15,931.

$14,872.

10. Inventory records for Marvin Company revealed the following:

Marvin sold 2,200 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be: (Do not round your intermediate calculations and round your final answer to nearest dollar amount. Round weighted-average unit cost to 4 decimals if necessary.)

Multiple Choice

$16,082.

$15,642.

$16,161.

$16,252.