Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 6 » Quiz 6 Sample Answers

Quiz 6

1 A company has beginning inventory for the year of $10,500. During the year, the company purchases inventory for $150,000 and ends the year with $27,000 of inventory. The company will report cost of goods sold equal to:

$166,500.

$177,000.

$133,500.

$150,000.

2. Tyler Toys has beginning inventory for the year of $19,700. During the year, Tyler purchases inventory for $234,000 and has cost of goods sold equal to $238,000. Tyler’s ending inventory equals:

Multiple Choice

$23,700.

$20,000.

$19,700.

$15,700.

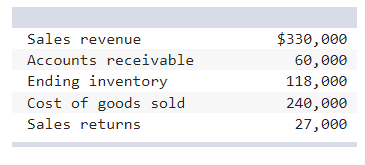

3. Given the information below, what is the gross profit?

Multiple Choice

$66,000.

$185,000.

$90,000.

$63,000.

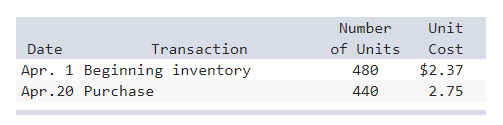

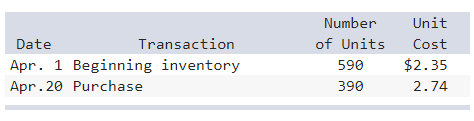

4. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 570 units of inventory during the month. Ending inventory assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$963.

$1,320.

$1,138.

$829.

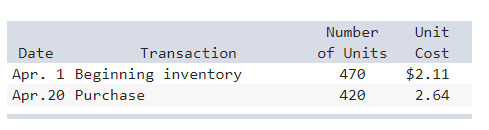

5. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 600 units of inventory during the month. Ending inventory assuming LIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$992.

$612

$766.

$1,109.

6. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 670 units of inventory during the month. Cost of goods sold assuming LIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$1,574.

$1,084.

$1,624.

$1595

7. Inventory records for Dunbar Incorporated revealed the following:

Dunbar sold 590 units of inventory during the month. Ending inventory assuming weighted-average cost would be: (Round weighted-average unit cost to 4 decimal places and final answer to the nearest dollar amount.)

Multiple Choice

$993.

$956.

$1,067.

$977.

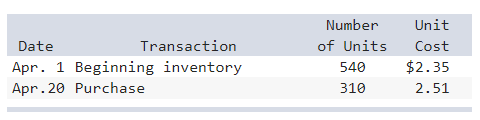

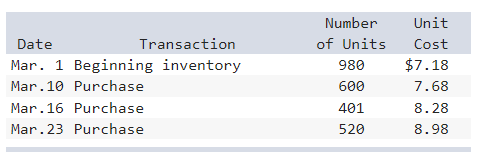

8. Inventory records for Marvin Incorporated revealed the following:

Marvin sold 1,860 units of inventory during the month. Ending inventory assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$1,282.

$5,671

$2,402.

$7,036.

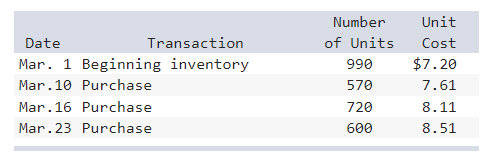

9. Inventory records for Marvin Company revealed the following:

Marvin sold 1,980 units of inventory during the month. Cost of goods sold assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

Multiple Choice

$16,722.

$16,850.

$15,931.

$14,872.

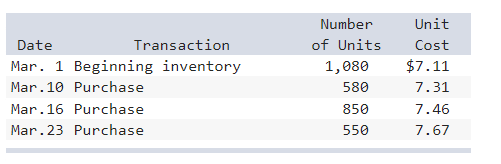

10. Inventory records for Marvin Company revealed the following:

Marvin sold 2,200 units of inventory during the month. Cost of goods sold assuming weighted-average cost would be: (Do not round your intermediate calculations and round your final answer to nearest dollar amount. Round weighted-average unit cost to 4 decimals if necessary.)

Multiple Choice

$16,082.

$15,642.

$16,161.

$16,252.

Quiz 6 Answers

1 A company has beginning inventory for the year of $10,500. During the year, the company purchases inventory for $150,000 and ends the year with $27,000 of inventory. The company will report cost of goods sold equal to:

$166,500.

$177,000.

$133,500.

$150,000.

Answer: $133,500.