Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 9

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Quiz 9

Quiz 9

1. A bond issue with a face amount of $510,000 bears interest at the rate of 10%. The current market rate of interest is also 10%. These bonds will sell at a price that is:

Equal to $510,000.

More than $510,000.

Less than $510,000.

The answer cannot be determined from the information provided.

2. A bond issue with a face amount of $508,000 bears interest at the rate of 7%. The current market rate of interest is 8%. These bonds will sell at a price that is:

Less than $508,000.

Equal to $508,000.

The answer cannot be determined from the information provided.

More than $508,000.

3. A $506,000 bond issue sold for $487,000. Therefore, the bonds:

Sold at a discount because the market interest rate was higher than the stated rate.

Sold at a discount because the stated interest rate was higher than the market rate.

Sold for the $506,000 face amount less $19,000 of accrued interest.

Sold at a premium because the stated interest rate was higher than the market rate.

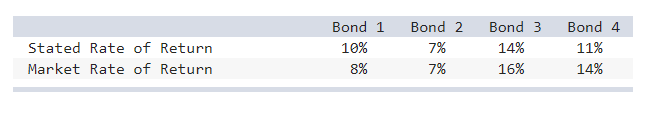

4. Given the information below, which bond(s) will be issued at a discount?

Bond 1.

Bond 3.

Bond 4.

Bonds 3 and 4.

5. Given the information below, which bond(s) will be issued at a premium?

Bond 1.

Bond 2.

Bond 3.

Bonds 1 and 4.

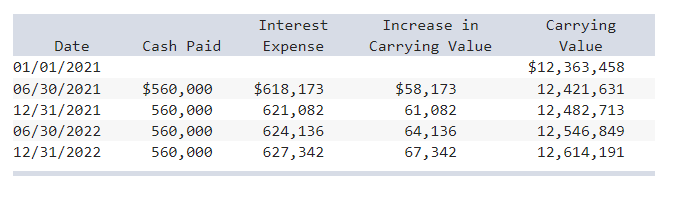

6. Discount-Mart issues $14 million in bonds on January 1, 2021. The bonds have a nine-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.)

10%.

8%.

9%.

4%.

7. Discount-Mart issues $13 million in bonds on January 1, 2021. The bonds have a seven-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the market annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.)

11%.

10%.

12%.

5%.

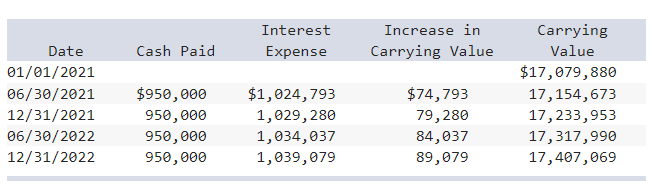

8. Discount-Mart issues $19 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the interest expense on the bonds in 2021?

$1,029,280.

$2,054,073.

$1,024,793.

$1,900,000.

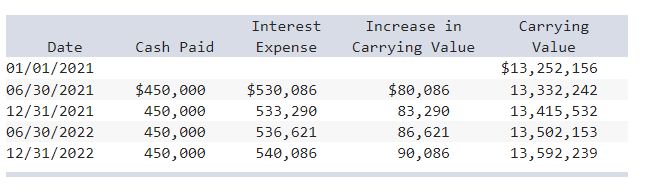

9. Discount-Mart issues $15 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the carrying value of the bonds as of December 31, 2022?

$13,502,153.

$13,415,532.

$13,592,239.

$14,492,239.

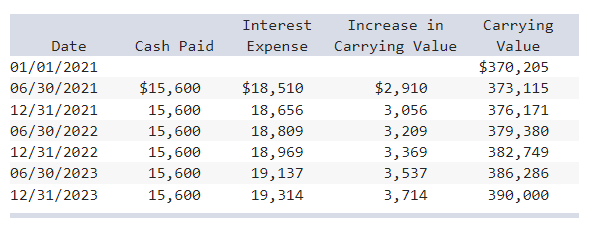

10 Tony Hawk’s Adventure (THA) issued callable bonds on January 1, 2021. THA’s accountant has projected the following amortization schedule from issuance until maturity:

THA issued the bonds for:

$390,000.

$370,205.

$483,600.

Cannot be determined from the given information.