Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 9 » Quiz 9 Sample Answers

Quiz 9

1. A bond issue with a face amount of $510,000 bears interest at the rate of 10%. The current market rate of interest is also 10%. These bonds will sell at a price that is:

Equal to $510,000.

More than $510,000.

Less than $510,000.

The answer cannot be determined from the information provided.

2. A bond issue with a face amount of $508,000 bears interest at the rate of 7%. The current market rate of interest is 8%. These bonds will sell at a price that is:

Less than $508,000.

Equal to $508,000.

The answer cannot be determined from the information provided.

More than $508,000.

3. A $506,000 bond issue sold for $487,000. Therefore, the bonds:

Sold at a discount because the market interest rate was higher than the stated rate.

Sold at a discount because the stated interest rate was higher than the market rate.

Sold for the $506,000 face amount less $19,000 of accrued interest.

Sold at a premium because the stated interest rate was higher than the market rate.

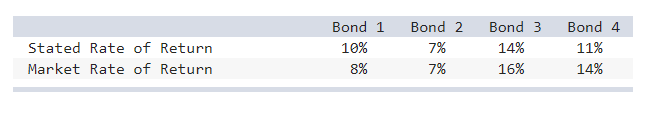

4. Given the information below, which bond(s) will be issued at a discount?

Bond 1.

Bond 3.

Bond 4.

Bonds 3 and 4.

5. Given the information below, which bond(s) will be issued at a premium?

Bond 1.

Bond 2.

Bond 3.

Bonds 1 and 4.

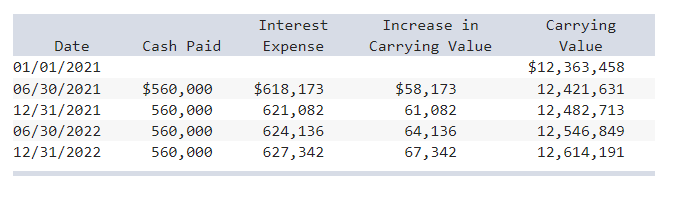

6. Discount-Mart issues $14 million in bonds on January 1, 2021. The bonds have a nine-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.)

10%.

8%.

9%.

4%.

7. Discount-Mart issues $13 million in bonds on January 1, 2021. The bonds have a seven-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the market annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) (Do not round your intermediate calculations.)

11%.

10%.

12%.

5%.

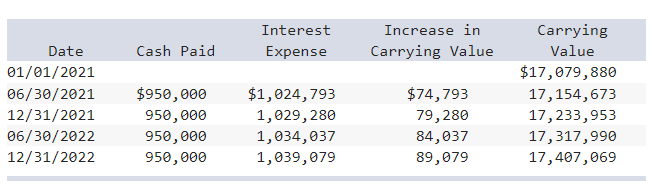

8. Discount-Mart issues $19 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the interest expense on the bonds in 2021?

$1,029,280.

$2,054,073.

$1,024,793.

$1,900,000.

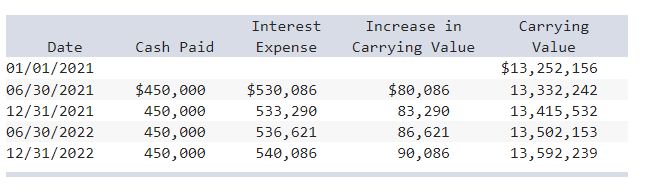

9. Discount-Mart issues $15 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds:

What is the carrying value of the bonds as of December 31, 2022?

$13,502,153.

$13,415,532.

$13,592,239.

$14,492,239.

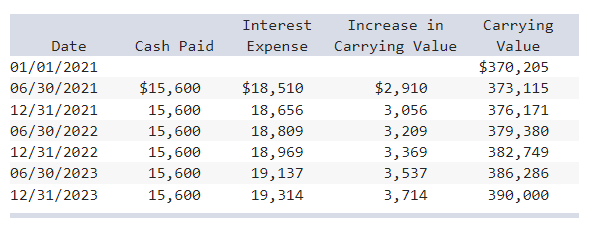

10 Tony Hawk’s Adventure (THA) issued callable bonds on January 1, 2021. THA’s accountant has projected the following amortization schedule from issuance until maturity:

THA issued the bonds for:

$390,000.

$370,205.

$483,600.

Cannot be determined from the given information.

Quiz 9 Answers

1. A bond issue with a face amount of $510,000 bears interest at the rate of 10%. The current market rate of interest is also 10%. These bonds will sell at a price that is:

Equal to $510,000.

More than $510,000.

Less than $510,000.

The answer cannot be determined from the information provided.

Answer: Equal to $510,000.