Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 12

With Answers Good news! We are showing you only an excerpt of our suggested answer to this question. Should you need our help in customizing an answer to this question, feel free to send us an email at  or chat with our customer service representative.

or chat with our customer service representative.

Quiz 12

Quiz 12

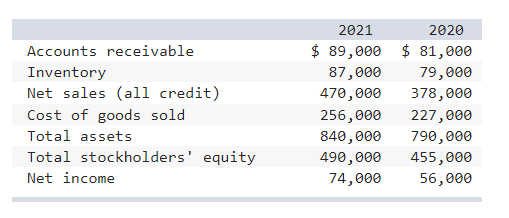

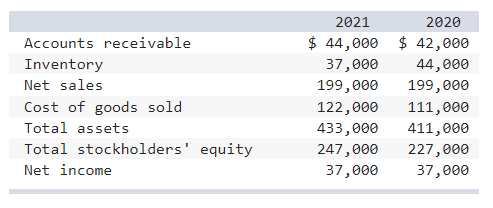

1. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 debt to equity ratio is:

Multiple Choice

8.52%.

73.49%.

14.46%.

30.38%.

2. Richard’s Sporting Goods reports net income of $170,000, net sales of $590,000, and average assets of $1,400,000. The return on assets is:

42.1%.

28.8%.

3.5 times.

12.1%.

3. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 inventory turnover is: (Round your answer to 1 decimal place.)

5.4 times.

3.1 times.

5.7 times.

2.9 times.

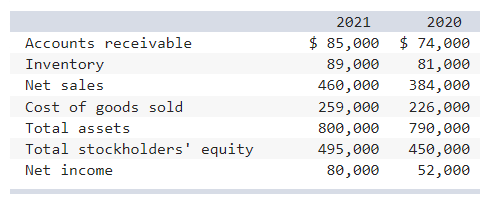

4. Excerpts from Stealth Company’s December 31, 2021 and 2020, financial statements are presented below:

Stealth Company’s 2021 receivables turnover ratio is:

6.68 times.

4.14 times.

5.18 times.

14.75 times.

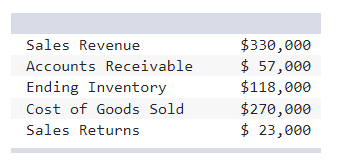

5. Given the information below, what is the company’s gross profit?

$60,000.

$39,000.

$304,000.

$37,000.

6. Richard’s Sporting Goods reports net income of $170,000, net sales of $550,000, and average assets of $1,700,000. The profit margin is:

30.9%.

4.2 times.

11.0%.

33.4%.

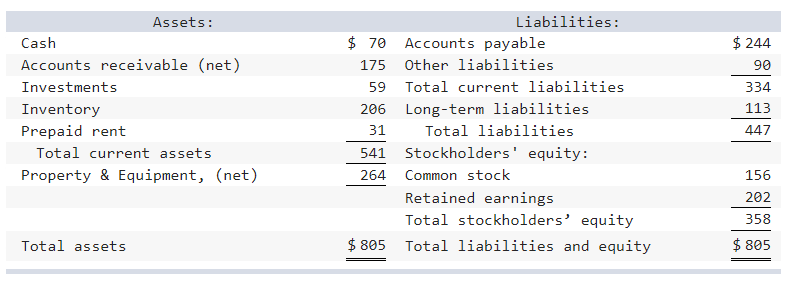

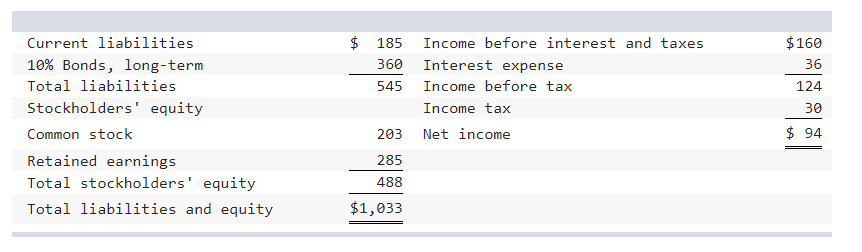

7. ‘ A partial balance sheet for Captain D’s Sportswear is shown below.

(dollars in thousands)

The debt to equity ratio is: (Round your answer to 2 decimal places.)

2.21.

0.93.

0.56.

1.25.

8. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 profit margin is: (Round your answer to 1 decimal place.)

17.4%.

10.1%.

3.0%.

1.5%.

9. Recent financial statement data for Harmony Health Foods (HHF) Inc. is shown below:

HHF’s times interest earned ratio is: (Round your answer to 2 decimal places.)

10.00.

4.44.

3.44.

2.61.

10. Excerpts from Stealth Company’s December 31, 2021 and 2020, financial statements are presented below:

Stealth Company’s 2021 debt to equity ratio is: (Round your answer to 1 decimal place.)

75.3%.

43.8%.

93.4%.

60.1%.