Navigation » List of Schools, Subjects, and Courses » Accounting 101 – Financial Accounting » Quizzes » Quiz 12 » Quiz 12 Sample Answers

Quiz 12

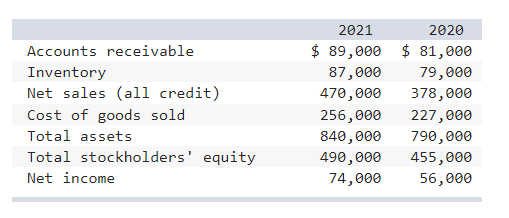

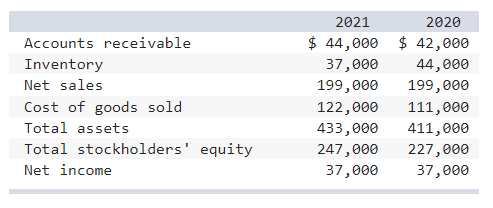

1. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 debt to equity ratio is:

Multiple Choice

8.52%.

73.49%.

14.46%.

30.38%.

2. Richard’s Sporting Goods reports net income of $170,000, net sales of $590,000, and average assets of $1,400,000. The return on assets is:

42.1%.

28.8%.

3.5 times.

12.1%.

3. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 inventory turnover is: (Round your answer to 1 decimal place.)

5.4 times.

3.1 times.

5.7 times.

2.9 times.

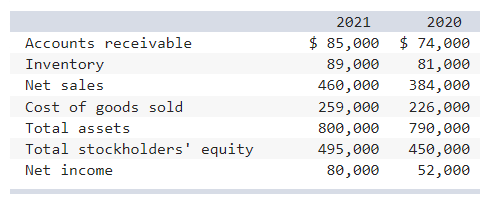

4. Excerpts from Stealth Company’s December 31, 2021 and 2020, financial statements are presented below:

Stealth Company’s 2021 receivables turnover ratio is:

6.68 times.

4.14 times.

5.18 times.

14.75 times.

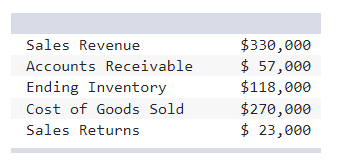

5. Given the information below, what is the company’s gross profit?

$60,000.

$39,000.

$304,000.

$37,000.

6. Richard’s Sporting Goods reports net income of $170,000, net sales of $550,000, and average assets of $1,700,000. The profit margin is:

30.9%.

4.2 times.

11.0%.

33.4%.

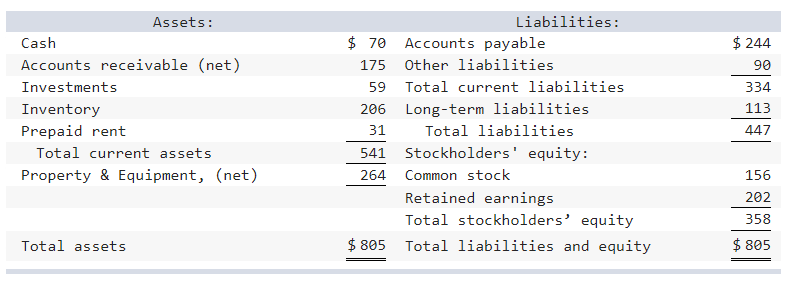

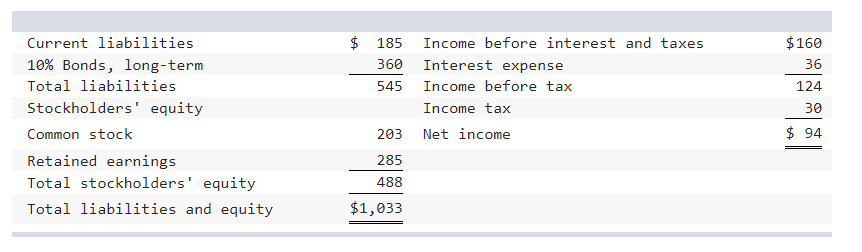

7. ‘ A partial balance sheet for Captain D’s Sportswear is shown below.

(dollars in thousands)

The debt to equity ratio is: (Round your answer to 2 decimal places.)

2.21.

0.93.

0.56.

1.25.

8. Excerpts from TPX Company’s December 31, 2021 and 2020, financial statements are presented below:

TPX Company’s 2021 profit margin is: (Round your answer to 1 decimal place.)

17.4%.

10.1%.

3.0%.

1.5%.

9. Recent financial statement data for Harmony Health Foods (HHF) Inc. is shown below:

HHF’s times interest earned ratio is: (Round your answer to 2 decimal places.)

10.00.

4.44.

3.44.

2.61.

10. Excerpts from Stealth Company’s December 31, 2021 and 2020, financial statements are presented below:

Stealth Company’s 2021 debt to equity ratio is: (Round your answer to 1 decimal place.)

75.3%.

43.8%.

93.4%.

60.1%.

Quiz 12 Answers

2. Richard’s Sporting Goods reports net income of $170,000, net sales of $590,000, and average assets of $1,400,000. The return on assets is:

42.1%.

28.8%.

3.5 times.

12.1%.

Answer: 12.1%.

Explanation: $170,000/$1,400,000 = 12.1%.